2026-02-14 23:02:19

Welcome to the Saturday PRO edition of How They Make Money.

Over 290,000 subscribers turn to us for business and investment insights.

In case you missed it:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

🌐 Cisco: AI Boom & Margin Squeeze

🛍️ Shopify: The Cost of Agentic Growth

⚙️ Applied Materials: AI Ramp Begins

🧬 AstraZeneca: Oncology Drives the Beat

🥤 Coca-Cola: Rare Miss & A New Boss

🍟 McDonald’s: The Grinch Wins Christmas

📶 T-Mobile US: Guidance to the Rescue

🌐 Arista Networks: AI Validation

📱 AppLovin: The Great Disconnect

🎮 NetEase: Hitting the Brakes

🪶 Robinhood: The Crypto Fade

🛖 Airbnb: Growth Acceleration

✈️ Expedia: B2B Powerhouse

🏨 Marriott: Credit Card Kicker

🏨 Hilton: Guidance Gloom

👜 Hermès: The Untouchable

💄 L'Oréal: Luxe Drag But Derma Shine

🧣 Kering: Not as Bad as Feared

🏎️ Ferrari: Luxury of Less

🚙 Ford: Tariff Shock

☁️ Cloudflare: The Agentic Internet

🐶 Datadog: Best in Show

📈 Coinbase: Cyclical Reset

💳 Adyen: Growth Reset

💳 Fiserv: Hard Reset

🌭 Kraft Heinz: The Great Pause

🍔 RBI: Burger King Remodels Slow

💬 Twilio: AI Infrastructure Pivot

🍞 Toast: Profitable Pivot

🏠 Zillow: Rentals Boom But Profit Gloom

👑 DraftKings: Prediction Gamble

📌 Pinterest: Exogenous Shock

📢 HubSpot: Agentic Pivot Pays Off

🚘 Lyft: Headline Shock

🏴 Klaviyo: Autonomous Growth

📆 Monday.com: Guidance Trap

Cisco’s Q2 FY26 (January quarter) revenue accelerated to 10% Y/Y growth, hitting $15.3 billion ($230 million beat), while adjusted EPS came in at $1.04 ($0.02 beat).

The AI infrastructure momentum continued. AI orders from hyperscalers jumped to $2.1 billion in the quarter (up from $1.3 billion in Q1). Consequently, management raised its FY26 AI orders outlook to exceed $5 billion, driven by demand for its Silicon One chips and 800G optical pluggables.

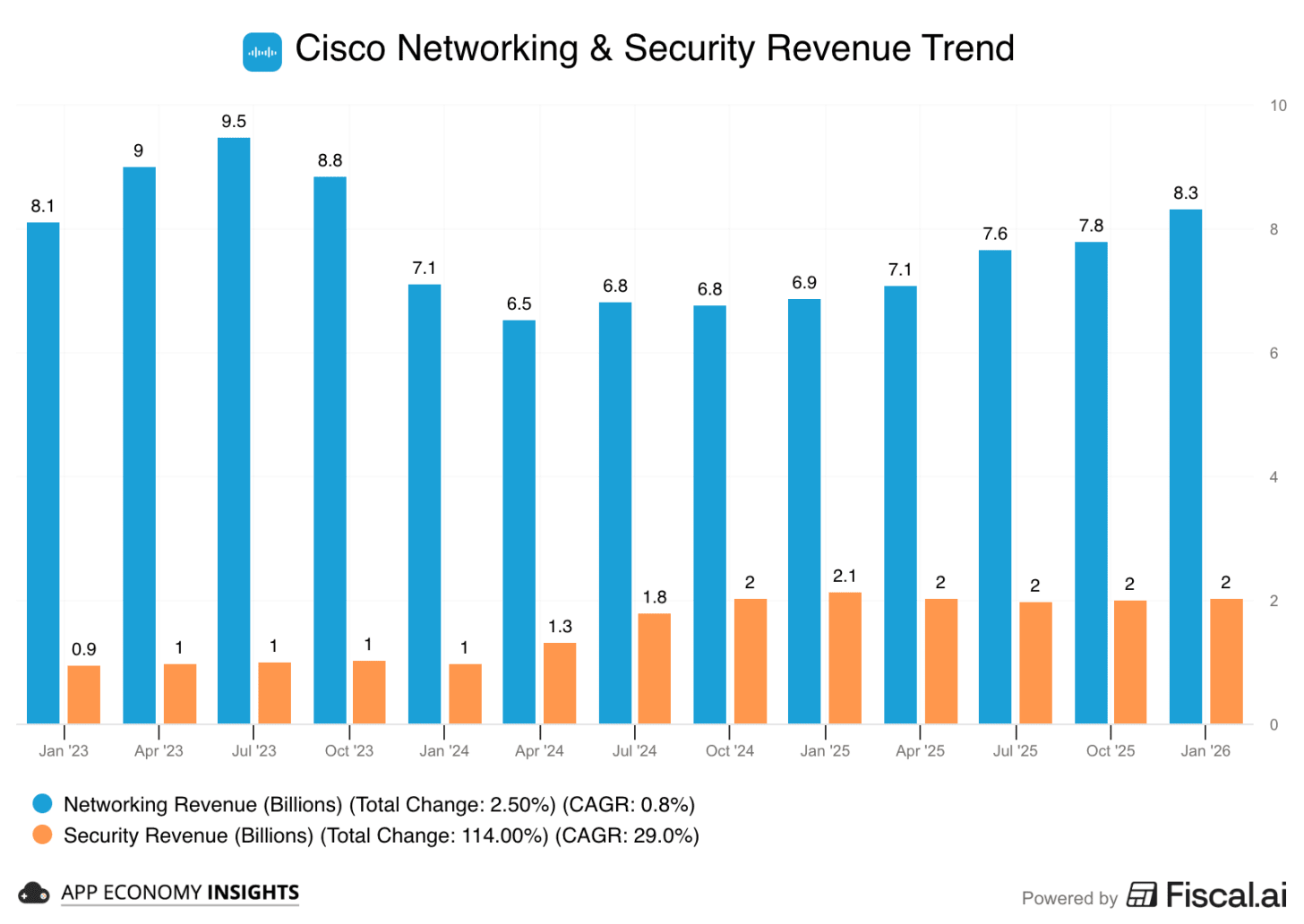

Networking revenue surged 21% Y/Y, fueled by the hyperscaler spend and a campus refresh cycle. However, Security revenue declined 4%, continuing to lag as the portfolio transitions and integrates Splunk (acquired in March 2024).

Despite the top-line beat and accelerating AI story, shares fell post-earnings due to a disappointing margin outlook. Management guided Q3 adjusted gross margins to ~66% (well below the 68.2% consensus), citing surging memory chip prices that are inflating costs faster than Cisco can raise prices.

Cisco raised its full-year FY26 guidance again, now forecasting revenue of $61.2–$61.7 billion (up from $60.2–$61.0 billion). The company also raised its quarterly dividend to $0.42 per share. While the AI growth thesis is playing out faster than expected, investors are now grappling with the near-term profitability tax of that growth.

Shopify closed FY25 with a high-octane quarter that highlighted a deepening tug-of-war between growth and profitability.

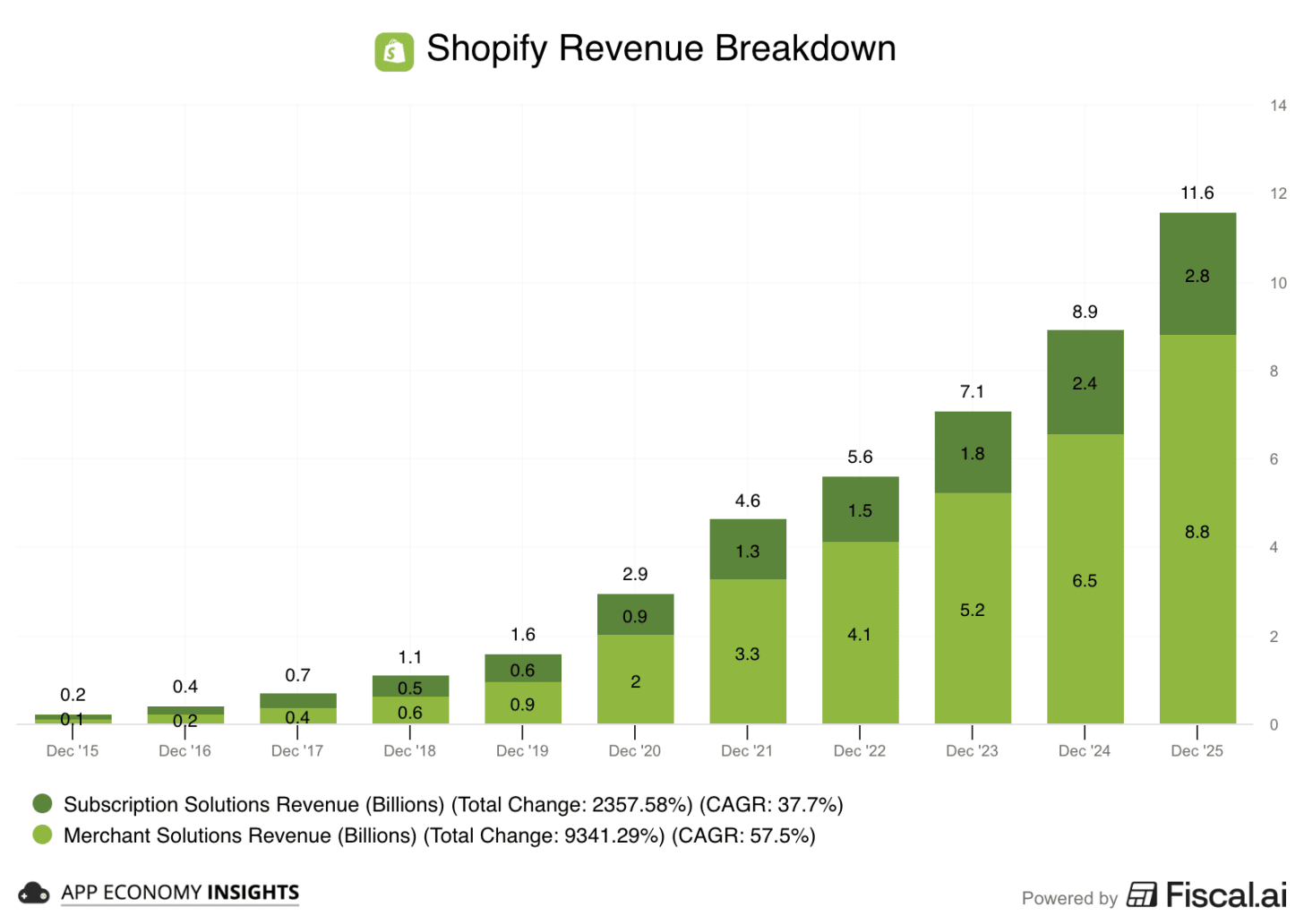

Q4 revenue surged 31% Y/Y to $3.7 billion ($80 million beat), and Gross Merchandise Volume (GMV) climbed 31% to $124 billion. For the full-year, revenue rose 30% Y/Y to $11.6 billion. This marked the highest annual revenue growth since the COVID boom of 2021.

The stock plunged despite the top-line beat and the authorization of a new $2 billion share buyback. The culprit was the bottom line. Adjusted EPS of $0.48 slightly missed the $0.51 consensus, and management guided for Q1 Free Cash Flow margins to dip into the “low-to-mid teens” (down from 19% in Q4) as they aggressively ramp up spending on AI. Sounds familiar?

The company is betting heavily on the Agentic Internet, launching the Universal Commerce Protocol (UCP) in collaboration with Google to allow AI agents to shop on behalf of consumers. While management argued that “no one is better positioned” for this shift, investors are punishing the immediate margin compression required to build this infrastructure.

On the bright side, the core business is firing on all cylinders. B2B GMV exploded 84% Y/Y, International revenue grew 36%, and the company guided for Q1 revenue growth in the “low-thirties”—significantly ahead of the 25% consensus.

2026-02-13 21:03:06

Welcome to the Free edition of How They Make Money.

Over 290,000 subscribers turn to us for business and investment insights.

In case you missed it:

The company proved it can grow at a slower pace and still earn more. The market responded with shares jumping nearly 20% after record margins.

At the same time, management is repositioning Spotify as the infrastructure layer of the music industry and pitching an agentic media vision built around discovery and personalization.

Let’s dig in.

Spotify is accelerating in ways that surprised even its own leadership.

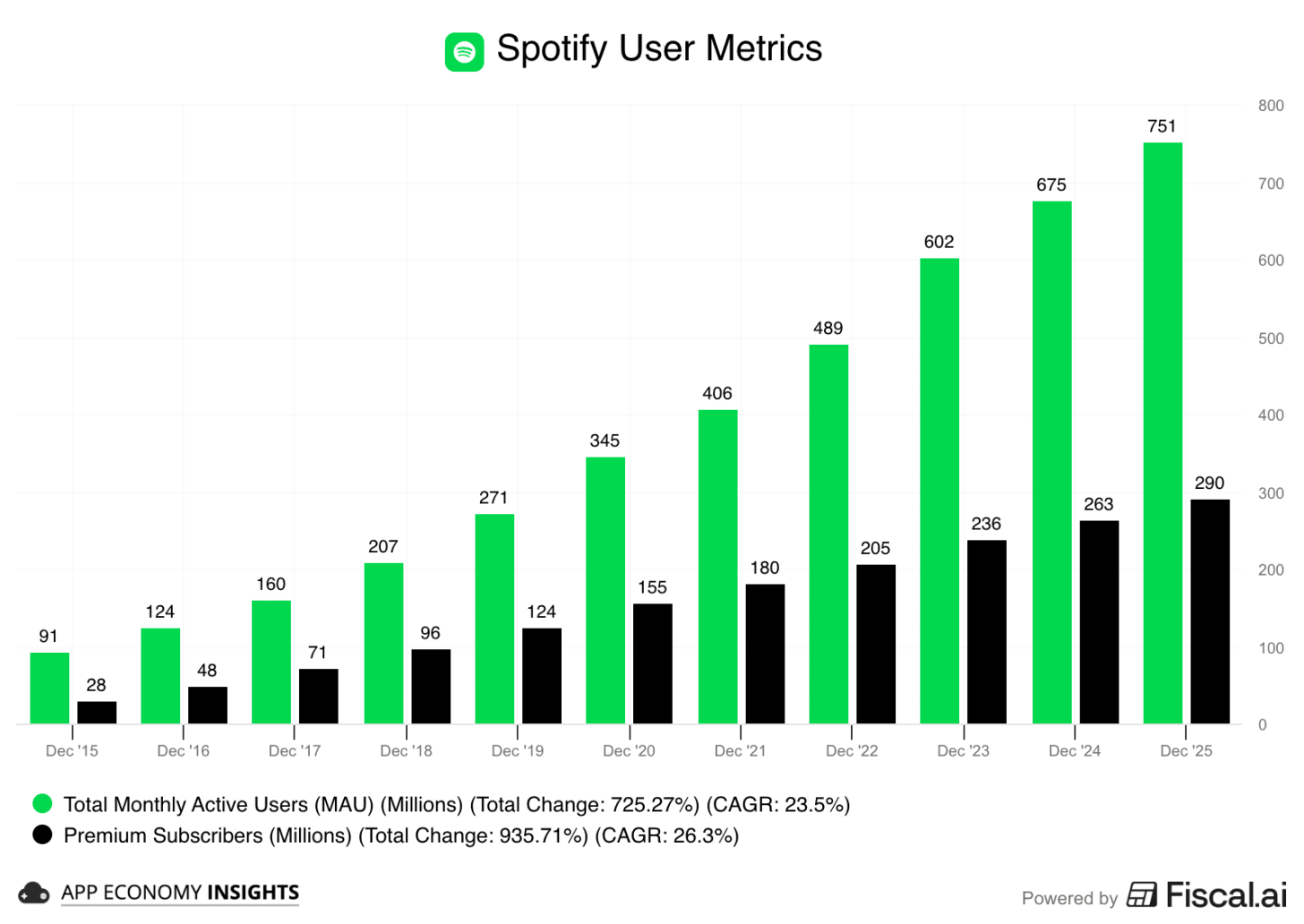

Monthly Active Users (MAUs): 751 million (+11% Y/Y). The company added a record 38 million net new users in Q4 alone, beating its own guidance by 6 million.

Premium Subscribers: 290 million (+10% Y/Y).

ARPU (Average Revenue Per User): €4.70, up 2% Y/Y in constant currency, benefiting from recent price hikes.

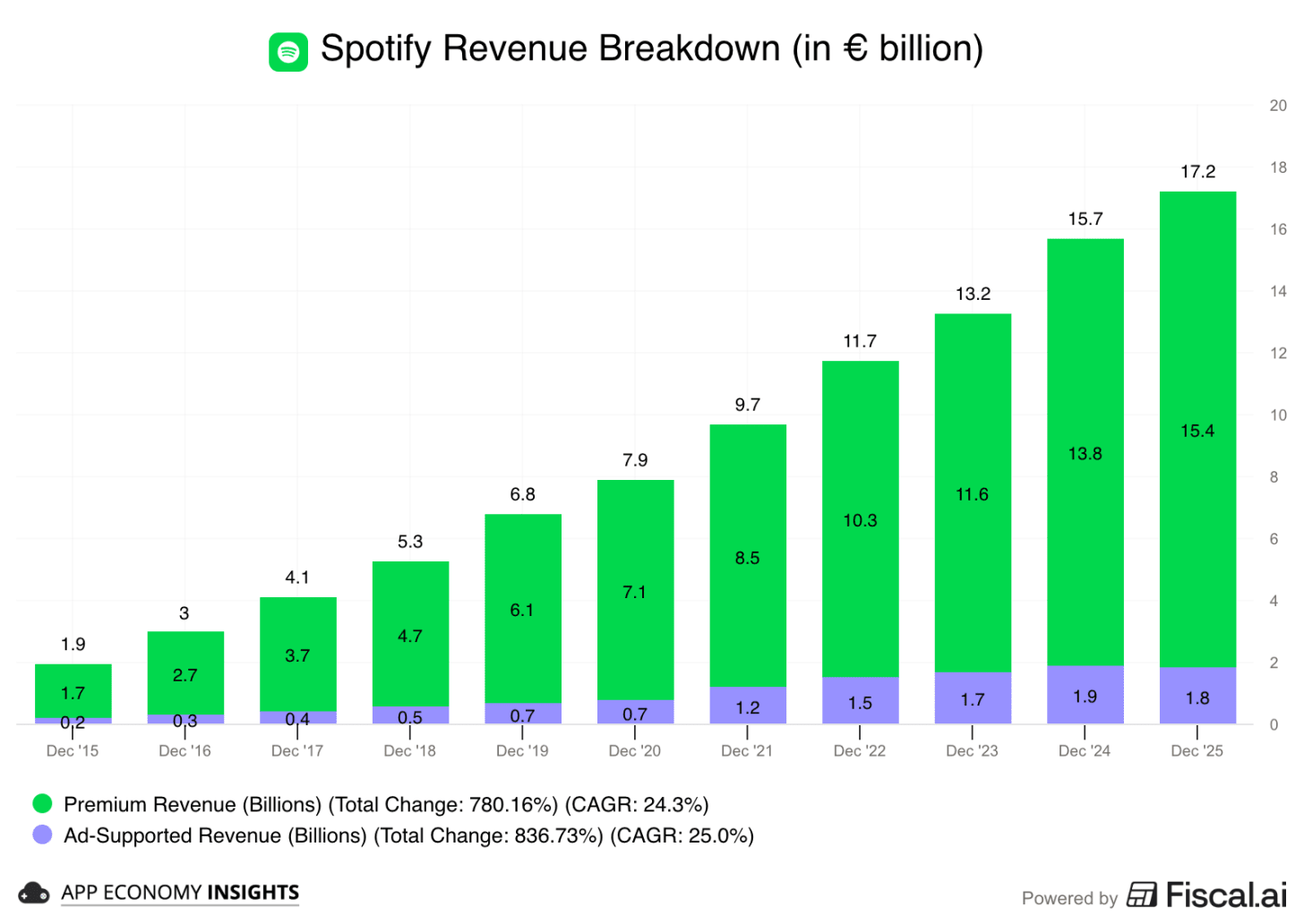

Revenue growth: +7% Y/Y to €4.5 billion (€10 million beat). Note that the company reports in euros and faced currency headwinds. Growth was +13% Y/Y in constant currency.

Gross margin: Expanded again to a record 33.1%, primarily thanks to an improvement in ad-supported gross margin, notably from podcasts.

Operating margin: 15% (a massive jump from 11% million a year ago).

Free cash flow: €834 million for the quarter and €2.9 billion for FY25.

Financially, the story has shifted from growth at all costs to margin expansion and shareholder returns. With €9.5 billion in cash and short-term investments, the company repurchased $433 million of its own shares during the quarter.

Management credited two major factors for the upbeat quarter:

The Wrapped effect: 2025 was the biggest Wrapped campaign ever. Over 300 million users engaged with their year-end recaps, driving the highest single day of subscriber sign-ups in the company’s history.

Product expansion: The rollout of audiobooks in more European markets and the beta launch of music videos in the US and Canada helped deepen user engagement.

This was Spotify founder Daniel Ek’s final quarter as CEO. Taking a page from the Netflix playbook, he passed the baton to two co-CEOs: Gustav Söderström (formerly Chief Product & Technology Officer) and Alex Norström (formerly Chief Business Officer).

Ek laid out a three-part framework for Spotify up to this point:

The intersection strategy: Spotify wins by solving problems at the intersection of consumers and creators. If a feature helps both, it’s a green light.

The R&D arm of music: Ek doesn’t see Spotify as a distributor but as the technology infrastructure for the music industry.

Ubiquity over control: Spotify works on over 2,000 devices from 200 brands. They chose to be everywhere rather than building a walled garden, which is why they believe they’re winning the “car and home” battle against Apple and Google.

The Ad-Supported segment remained the clear low-light. Ad revenue grew only 4% Y/Y in constant currency (it declined 4% Y/Y on a reported basis), continuing a trend of soft monetization that stands in stark contrast to the subscription side of the house.

Despite a massive base of 476 million ad-supported MAUs (up 12% Y/Y), Spotify still struggles to translate eyeballs into dollars as efficiently as Big Tech. Management has previously signaled that 2025 was a transition year for ads, but with growth not expected to truly accelerate until the second half of 2026, this segment acts as a persistent drag on the overall growth story.

The real insight, however, is the gross margin expansion within the ad tier, which hit record levels primarily due to “content cost favorability” in podcasting. For years, podcasts were a massive cash burn. They are now finally becoming margin-accretive. By pivoting from expensive exclusive deals to a broader marketplace model, Spotify is proving it can make the ad business profitable even if it isn’t yet a high-growth engine.

The strategic bet is that Spotify can eventually unlock the kind of high-ARPU targeted advertising that powers Meta and YouTube. That outcome is far from guaranteed.

Audio has structural limits. Unlike visual feeds, ads cannot be scrolled past. Ad load is constrained. That likely caps ARPU below video and social platforms.

There is also a data quality gap. Spotify understands moods and habits, but it lacks the high-intent commercial signals that make Google and Meta so effective for performance marketing. Mood data supports branding. It does not drive clicks.

Spotify does not see AI as a threat. It sees it as leverage.

Co-CEO Gustav Söderström argues that disruption isn’t caused by technology alone. It’s caused by new business models enabled by that technology. Spotify’s bet is that AI won’t eliminate aggregators. It will make them more important.

If AI makes it easier to create music, the world will drown in supply. When supply becomes infinite, discovery becomes scarce. And discovery is Spotify’s core product.

Already, 90 million users engage with the AI DJ. The new Prompted Playlist feature lets users “write their own algorithm,” turning Spotify into an interactive recommendation engine rather than a passive library. Users can also exclude suggested songs, like creating new rules for an LLM.

This is the key. AI threatens creators more than platforms. The more content exists, the more valuable the filter becomes.

Spotify is positioning itself as that filter. Management called it an “agentic media platform” that translates language, mood, and context into taste.

If that works, AI doesn’t compress Spotify’s moat. It widens it.

Spotify does not own its content. Labels capture close to 70% of revenue. The catalog is largely the same across Apple, YouTube, and Amazon.

So where is the edge?

It lives in experience, data, and scale:

Personalization at depth: Spotify is building a dataset that connects language to taste at global scale. “Workout music” or “sad songs” are not objective categories. They are subjective signals defined by hundreds of millions of users every day. That feedback loop trains recommendation systems that are difficult to replicate without similar scale and engagement.

Network gravity: With 751 million monthly users, Spotify is the default destination for audio. Artists and podcasters launch where distribution is largest. Innovation compounds where attention concentrates. That reinforces Spotify’s position as the primary discovery engine in music.

Behavioral switching costs: Playlists, follows, listening history, and algorithmic tuning create friction. The subscription price is low. The time invested is not. Research firm Antenna estimates Spotify’s net churn at around 2%, with nearly 90% of audio users sticking to a single platform.

This is not a wide moat built on exclusive content. It is a narrow moat built on habit, data, and distribution scale.

AI can make the music, but Spotify is where it breaks into the culture. As long as Spotify owns the charts and the discovery, they own the power over creators. A simple algorithm push can make or break an artist, a la Netflix.

Scale alone brings new business opportunities. For example, Spotify just partnered with bookshop.org, allowing listeners in the US and the UK to buy physical books in one click from the app. It’s an example of a strategy trying to meet customers where they are and cater to their extra needs, whatever they might be.

YouTube remains the primary long-term challenger. While Spotify is the king of audio, Alphabet’s video giant owns the world’s attention. YouTube currently boasts over 2.7 billion MAUs. This scale is more than 3.5x larger than Spotify’s user base, giving YouTube an almost unfair funnel for its music services.

YouTube Music and Premium crossed 125 million subscribers in March 2025, up from 100 million a year prior. YouTube has been adding ~2 million paid subs per month on average, essentially matching Spotify’s pace. The paid subscriber base is likely close to 145 million by now, roughly half of Spotify’s Premium subs.

Alphabet is increasingly pushing its “unified content” bundle, where $13.99/month removes ads from the world’s largest video platform while simultaneously providing its music streaming service.

As YouTube Premium’s subscriber base rises, it creates a default subscription that could eat Spotify’s lunch. For a user already paying for ad-free YouTube and getting Music as a bonus, an extra $12.99/month for Spotify becomes a redundant “music tax.” YouTube Music also leverages a decade of video watch history to inform its recommendations—implicit data that Spotify’s “likes” and “saves” struggle to match. As Gen Z increasingly treats YouTube as their primary discovery engine (serving both video and audio), Spotify’s narrow moat will depend on its ability to prove that its standalone experience is worth the extra cost of a separate subscription.

Can Spotify turn cultural relevance into economic power? Can it raise ARPU without damaging the user experience? Can it defend its role as the primary music discovery engine as YouTube bundles music into a broader ecosystem?

Spotify now has the scale, data, and cash flow to execute. Yet audio carries structural limits that may cap ARPU expansion. The next phase likely requires new monetization layers beyond the current model.

Investor Day in May should provide clearer signals on how management intends to translate that foundation into sustained operating leverage.

That’s it for today!

Stay healthy and invest on!

Thanks to Fiscal.ai for being our official data partner. Create your own charts and pull key metrics from 50,000+ companies directly on Fiscal.ai. Start an account for free and save 15% on paid plans with this link.

Disclosure: I own AAPL, AMZN, GOOG, and META in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with members.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.

2026-02-10 21:03:43

Welcome to the Premium edition of How They Make Money.

Over 290,000 subscribers turn to us for business and investment insights.

In case you missed it:

While the Seahawks and Patriots battled on the turf on Sunday, the real heavy-hitting happened in the ad breaks.

Anthropic decided to go for the jugular with a series of Super Bowl spots mocking OpenAI’s pivot toward a subsidized, ad-supported ChatGPT. Sam Altman fired back on X, calling the ads "clearly dishonest," and labeling Anthropic’s approach as "expensive products for rich people." The era of ad-free AI has become a marketing battleground for users and talent.

While AI labs fight for the soul of the software, the hardware world is fighting for the silicon to run it. Memory suppliers are prioritizing High-Bandwidth Memory (HBM) for AI data centers, leading to a memory crunch.

That brings us to the companies most exposed to the shortage. There’s a quiet reshuffling of power across consumer electronics, semiconductors, and platform economics.

Today at a glance:

🎮 Sony: Hardware Retreat

📲 Qualcomm: Memory Wall

☁️ Arm: Cloud AI Engine Ignites

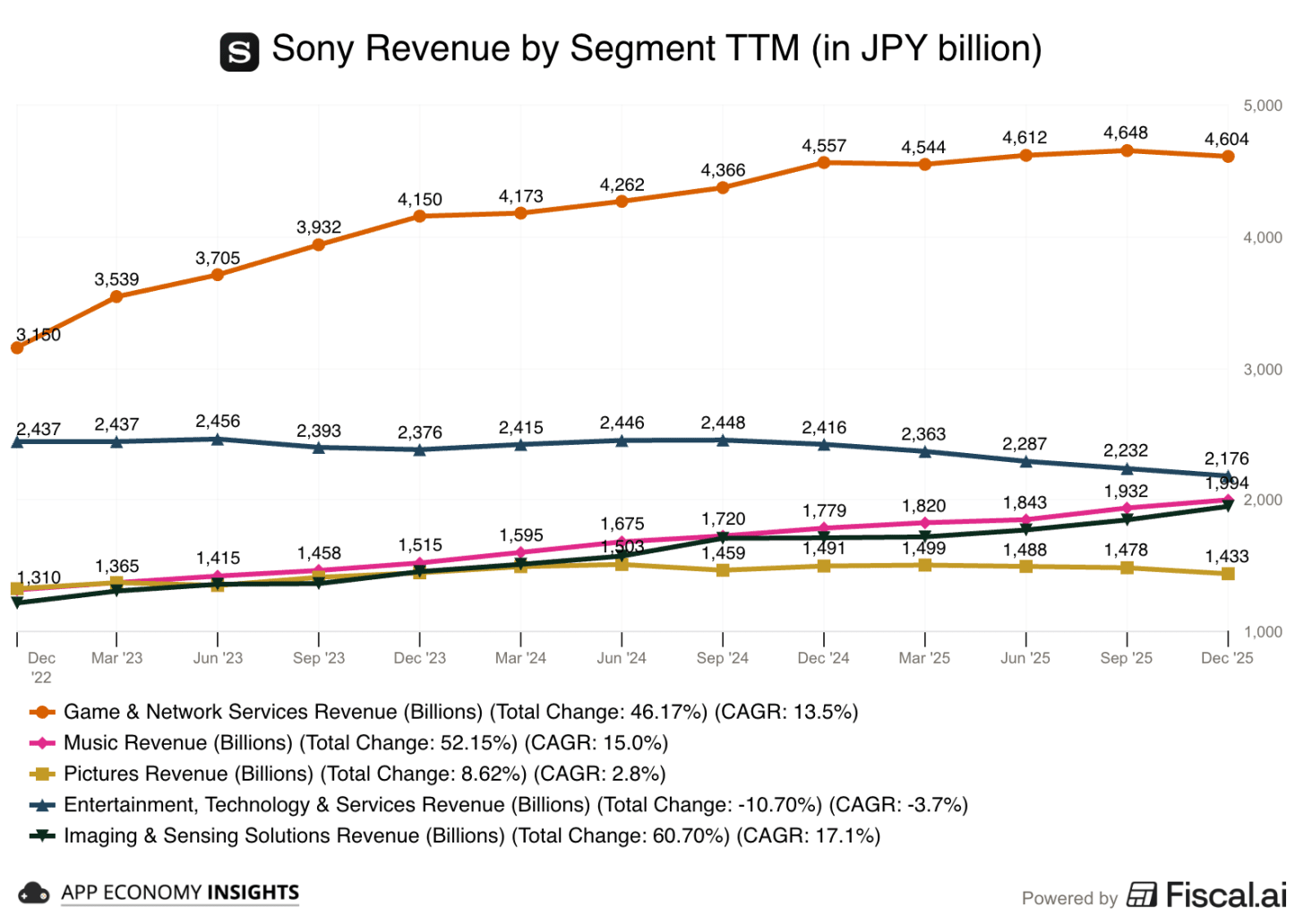

Sony delivered a record-high operating profit for the holiday quarter (Q3 of the fiscal year ending in March), even as hardware sales for its flagship gaming console began to soften.

Sales were up just 1% Y/Y to ¥3.71 trillion (¥44 billion beat), which is roughly $23.5 billion. Operating margin improved to 14% from 12% a year ago.

The PlayStation 5 is entering the mature phase of its life cycle. Sony shipped 8 million units this quarter, a 16% drop from the 9.5 million shipped a year ago. The console has sold a cumulative total of 92 million units.

While hardware units linger, record-high software revenue on the PlayStation Store and a 13% jump in network services revenue boosted the gaming division’s operating profit, which surged 19% Y/Y.

Digital downloads and subscriptions are the main drivers here. Ghost of Yōtei was a massive catalyst, selling 3.3 million copies in its first month and outpacing the early sales of its predecessor, Ghost of Tsushima. PlayStation Network (PSN) Monthly Active Users rose 2% Y/Y to 132 million, which includes players on PS4 and PC.

The global shortage of DRAM (memory chips), driven by investments in AI and data centers, is increasing manufacturing costs. Contract prices are projected to rise 90% to 95% this quarter.

CFO Lin Tao assured investors that Sony has secured the “minimum volume required” to mitigate the crunch. She has signaled an intentional extension of the PS5 life cycle, describing the console as being only at its “midpoint.” This aligns with rumors of a delay of the PlayStation 6, possibly into 2028 or 2029, to avoid launching at a prohibitively high retail price.

While supply is secure, higher costs will weigh on hardware margins. Sony plans to absorb these costs by leaning on its installed base of PS5 owners to buy more software and subscriptions. The company is pivoting toward a services-first model.

Revenue in the Imaging & Sensing Solutions (I&SS) segment jumped 21%. This was largely driven by strong demand for high-end sensors in flagship smartphones, including the popular iPhone 17 we discussed here.

The recent pivot goes beyond the gaming segment. The company’s long-term strategy is to continue exiting low-margin manufacturing.

📺 Bravia-TCL deal: In a move that signals the end of an era, Sony is spinning off its TV business into a joint venture with TCL. The company will hold a 51% controlling stake, while Sony retains 49%. Sony will provide the “brains” (image processing and brand prestige), while TCL provides the “brawn” (manufacturing scale and supply chain efficiency). This move aims to turn the perennially struggling TV division (Entertainment, Technology & Services) into a stable, profitable entity.

🐶 Owning the IP: Sony is doubling down on content ownership. It recently increased its stake in Peanuts Holdings (Snoopy) to 80%, contributing a ¥45 billion gain to its forecast. By owning the IP, Sony ensures its music and film divisions remain essential to platforms like Netflix and Spotify.

💰 Financial streamlining: The partial spin-off of Sony Financial Group is now in effect. This allows Sony to focus its capital and attention entirely on its identity as a “Creative Entertainment Company.”

🔮 Looking forward: Sony raised its full-year operating profit forecast by 8% to ¥1.54 trillion (¥0.11 billion raise). The company may be moving fewer hardware units, but the unit economics are better than ever.

2026-02-07 23:02:28

Welcome to the Saturday PRO edition of How They Make Money.

Over 280,000 subscribers turn to us for business and investment insights.

In case you missed it:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

↗️ AMD: Data Center Acceleration

🕵️ Palantir: 'N of 1' Growth Story

🚖 Uber: 200 Million Users Strong

💊 Eli Lilly: Trading Price for Volume

⏳ AbbVie: Humira’s Last Stand?

🧬 Novartis: The Patent Cliff Arrives

🦠 Merck: The Cost of the Bridge

🇩🇰 Novo Nordisk: Growth Era Ends

🧬 Amgen: Volume Over Value

💉 Pfizer: Transition Year

🍄 Nintendo: Switch 2’s Big Problem

🥤 PepsiCo: The Price Reset

🍪 Mondelez: The Cocoa Hangover

🔒 Fortinet: SASE Acceleration

🌯 Chipotle: Traffic Turns Negative

🌮 Yum! Brands: The Tale of Two Chains

💳 PayPal: Execution Stumbles & CEO Exit

👾 Roblox: Wild Rollercoaster

🎮 Take-Two: GTA VI Confidence Restored

🍫 Hershey: The Sweetest Outlook

👽 Reddit: Buyback Surprise

☁️ Atlassian: Billion-Dollar Cloud Quarter

🌈 Affirm: Card Compounding

👻 Snap: The Profit Pivot

🗞️ NYT: Ad Boom But Cost Gloom

🦷 Align: The Volume Recovery

🔥 Match Group: Project Aurora Sparks Hope

🚲 Peloton: The Turnaround Stalls

AMD delivered Q4 revenue growth of 34% Y/Y to $10.3 billion ($630 million beat) and adjusted EPS of $1.53 ($0.21 beat).

The growth engine is led by the Data Center segment, which surged 39% Y/Y to $5.4 billion ($0.4 billion beat) as adoption of the MI300 AI accelerator and EPYC processors continues to scale. Notably, AMD successfully navigated export controls to ship $390 million in legacy MI308 AI chips to China during the quarter.

Client and Gaming revenue also impressed, growing a combined 39% Y/Y to $3.9 billion. Client revenue rose 34% to $3.1 billion, while Gaming revenue saw a surprising 50% surge to $843 million, driven by renewed demand for Radeon GPUs.

Management issued strong Q1 guidance, projecting revenue of ~$9.8 billion (well above the $9.4 billion consensus) and gross margins of ~55%. This outlook includes an expected ~$100 million in further MI308 sales to China.

Despite the beat, shares dropped in after-hours trading, as investors may have priced in even higher AI upside or sought to rotate out of the extended semiconductor sector.

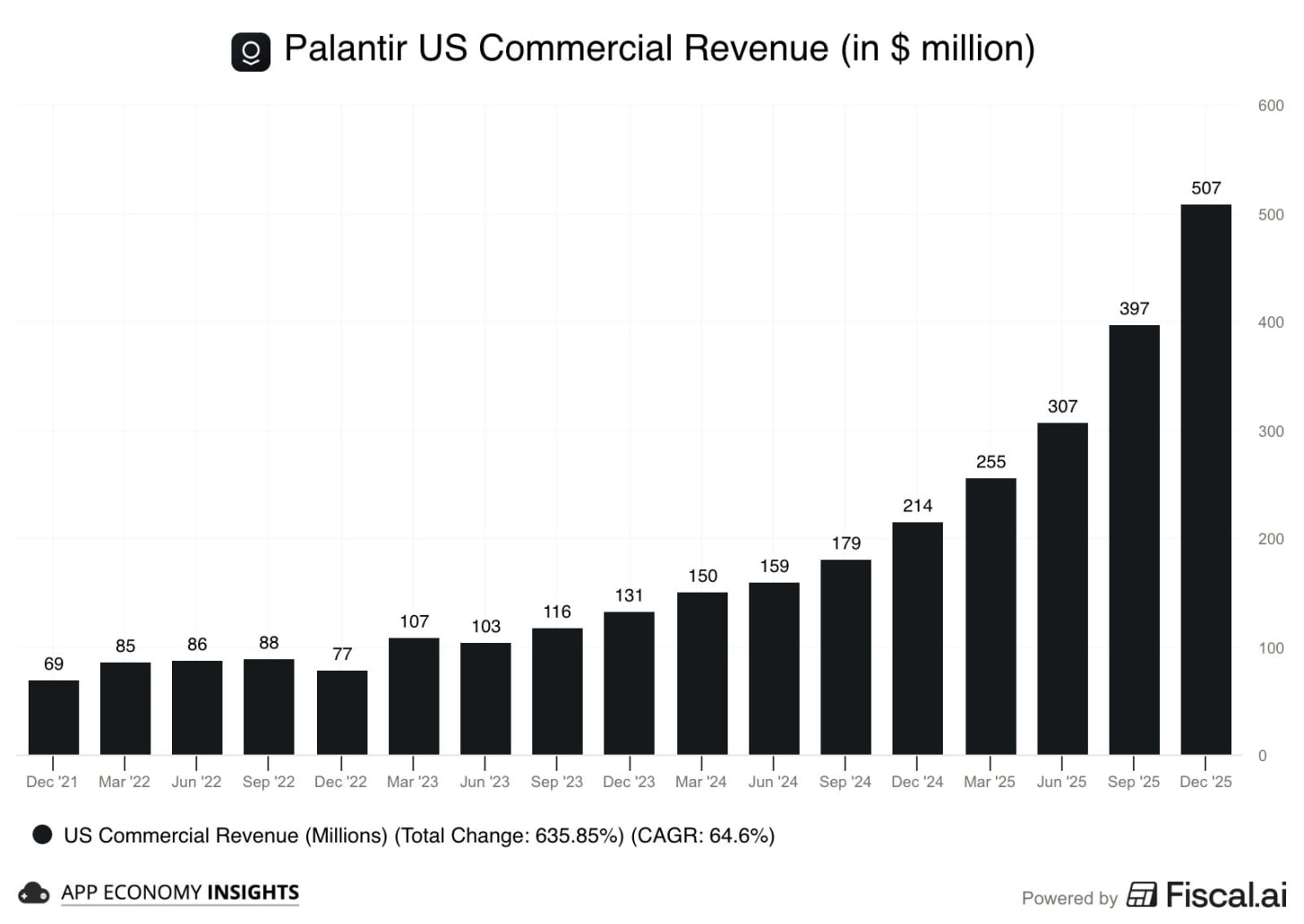

Palantir delivered a stunning Q4, with revenue accelerating to 70% Y/Y growth at $1.4 billion ($60 million beat) and non-GAAP EPS hitting $0.25 ($0.02 beat). The Rule of 40 score climbed to a record 127%, proving the company is scaling with elite efficiency.

The ‘otherworldly’ growth story from Q3 somehow found another gear. US Commercial revenue exploded 137% Y/Y to $507 million (accelerating from +121% in Q3), driven by a frenzy of AI Platform (AIP) bootcamps converting to massive deals.

US Government revenue also re-accelerated, growing 66% Y/Y to $570 million (the Government segment grew 60% Y/Y globally). Total Contract Value (TCV) hit a record $4.26 billion for the quarter (+138% Y/Y), securing a massive backlog of future revenue.

Management issued a blowout outlook for FY26, guiding for revenue to grow 61% Y/Y to $7.2 billion ($0.9 billion beat). They expect US Commercial revenue alone to exceed $3.1 billion (+115% growth). CEO Alex Karp declared Palantir an “N of 1,” stating the company is in a league of its own in capitalizing on “commodity cognition” (ubiquitous AI models).

Palantir has delivered two consecutive flawless quarters, yet the stock has remained flat over the last six months. This signals a healthy period of valuation digestion. Trading at ~70x forward EBITDA, Palantir commands a massive premium, but with 60%+ growth expected in FY26, it’s one of the few software names growing fast enough to justify it. PLTR is up nearly 10x since it entered our real-money portfolio in January 2024. The fundamentals are finally catching up to the price.

2026-02-06 21:02:43

Welcome to the Free edition of How They Make Money.

Over 280,000 subscribers turn to us for business and investment insights.

In case you missed it:

Amazon (AMZN) is no longer just providing the picks and shovels for the AI gold rush. It is now funding the whole mine.

CEO Andy Jassy explained:

“With such strong demand for our existing offerings and seminal opportunities like AI, chips, robotics, and low earth orbit satellites, we expect to invest about $200 billion in capital expenditures across Amazon in 2026 and anticipate strong long-term return on invested capital.”

With Google announcing ~$180 billion in CapEx for FY26 on Wednesday, it was safe to expect Amazon to come out with an even bigger number. After all, Amazon doesn’t spend a penny on stock buybacks or dividends. As a result, the company can plow even more toward future growth.

Amazon has the luxury of having a business that generated nearly $140 billion in operating cash flow in 2025 and has a stellar balance sheet. Funding this CapEx ramp is not a problem.

That doesn’t change the fact that these numbers are truly staggering. The market is increasingly anxious about how these investments will play out, as their impact will take many years to materialize. Though, to be fair, the 'Day 1' company has earned the benefit of the doubt.

But wait, there’s more!

Reports surfaced last week that Andy Jassy is in advanced talks to lead a $50 billion investment in OpenAI. If finalized, this would be the largest single check to a private company in tech history, marking a definitive end to the Microsoft-OpenAI monogamy. It would represent half of OpenAI’s massive $100 billion round at a $830 billion valuation reported by The Wall Street Journal.

The strategic logic is a two-fer for Jassy:

Guaranteed AWS boost: OpenAI’s insatiable hunger for cash gives Amazon a unique opening to migrate some of the world’s most high-profile AI workloads onto AWS. This would fund the $38 billion infrastructure deal signed in late 2025, and then some.

Arming the competitor’s competitor: If AGI is the future, Jassy cannot afford to let Gemini get too far ahead. Since OpenAI's greatest needs are liquid capital and specialized compute, Jassy is happy to provide both. He’s effectively ensuring that the next generation of intelligence also runs on Amazon’s custom silicon.

By funding OpenAI’s vision, Amazon ensures OpenAI has the capital to compete for the foreseeable future. But it doesn’t guarantee commercial success for Sam Altman & Co. When the bill comes due, OpenAI will still need a business that can spew tens of billions in profit to make it all worthwhile.

Today at a glance:

Amazon Q4 FY25.

Latest business moves.

Key quotes from the call.

What to watch moving forward.

Income statement:

Revenue breakdown:

💻 Online stores (39% of overall revenue): Amazon.com +10% Y/Y.

🏪 Physical store (3%): Primarily Whole Foods Market +5% Y/Y.

🧾 3rd party (25%): Commissions, fulfillment, shipping +11% Y/Y.

📢 Advertising (10%): Ad services to sellers, Twitch +23% Y/Y.

📱 Subscription (6%): Amazon Prime, Audible +14% Y/Y.

☁️ AWS (17%): Compute, storage, database, & other +24% Y/Y.

Other (1%): Various offerings, small individually +7% Y/Y.

Revenue rose +14% Y/Y to $213.4 billion ($2.2 billion beat).

Gross margin was 48% (+1pp Y/Y).

Operating margin was 12% (+0pp Y/Y).

AWS: 35% margin (-2pp Y/Y).

North America: 9% margin (+1pp Y/Y).

International: 2% margin (-1pp Y/Y).

EPS $1.95 ($0.01 miss).

Cash flow:

Operating cash flow TTM was $139.5 billion (+20% Y/Y).

Free cash flow TTM was $11.2 billion (-71% Y/Y), driven by the operating cash flow growth, offset by a 65% rise in Capex to $128.3 billion.

Balance sheet:

Cash, cash equivalent, and marketable securities: $123 billion.

Long-term debt: $66 billion.

Q1 FY26 Guidance:

Revenue ~$176 billion or +13% Y/Y in the mid-range ($0.8 billion beat).

Operating income ~$19 billion or +3% Y/Y in the mid-range ($22 billion expected).

☁️ AWS hits the gas: AWS revenue surged 24% Y/Y, its fastest acceleration in over three years. While it still trails the growth rates of Azure (38% in constant currency) and Google Cloud (48%), it’s from a much larger revenue base. Jassy noted that Amazon's own AI chips are seeing triple-digit growth as customers seek price-performance alternatives to NVIDIA.

📦 Retail efficiency paying off: North America margins expanded to 9% following a large restructuring effort. However, the retail story is now one of ruthless prioritization. Amazon is officially closing all Amazon Fresh and Amazon Go locations (72 stores) and sunsetting the Amazon One palm-payment system by June. If an experiment doesn't have a path to massive scale, it gets cut to fund the AI war chest.

📢 Advertising as a margin pillar: Ad revenue grew 23% to roughly $21 billion this quarter, continuing to outpace retail growth. The high-margin nature of this segment—boosted by Prime Video's new ad tiers—is the secret sauce keeping company-wide operating margins at 12%.

🔮 Guidance for a new scale: Q1 operating income guidance of ~$19 billion came in below analyst estimates. The company expects to absorb a $1 billion incremental cost headwind for Amazon Leo (the rebranded Project Kuiper) in the first quarter alone. While Leo offers huge upside potential, it will weigh on profitability throughout 2026.

Q4 included roughly $1.8 billion in severance costs from the Project Dawn layoffs.

In January, Amazon moved to aggressively flatten its corporate hierarchy, confirming a second wave of 16,000 job cuts. This brings the total reduction to roughly 30,000 corporate roles since October (~10% of the corporate workforce).

Jassy is framing Project Dawn as a move to remove layers of middle management and bureaucracy to return to a “startup” culture. Management explicitly noted that efficiency gains from generative AI are allowing the company to operate with a smaller corporate headcount.

In January, Amazon expanded its healthcare footprint by launching an agentic Health AI assistant within the One Medical app.

The assistant is designed to handle agentic tasks like managing medications, explaining lab results, and booking appointments based on a patient’s specific medical history.

This creates a tighter link between Amazon’s primary care services and its pharmacy delivery, aiming to make healthcare a frictionless part of the Prime ecosystem.

At the November 2025 “unBoxed” conference, Amazon officially merged its Demand Side Platform (DSP) and Sponsored Ads into a single, unified Campaign Manager.

The update removes the friction between upper-funnel (streaming/display) and lower-funnel (search) ads, giving advertisers a holistic view of ROAS.

A new AI-powered “Ads Agent” now allows marketers to query performance data using natural language, democratizing complex data analysis for smaller sellers.

Check out the earnings call transcript on Fiscal.ai here.

“AWS is now a $142 billion annualized run rate business [...] As fast as we install this AI capacity, we are monetizing it. So it’s just a very unusual opportunity.”

Jassy is refuting any market-share anxiety and has highlighted that AWS is adding more absolute dollars than rivals. He sees the current AI boom as a structural shift that justifies the massive CapEx ramp.

“Our chips business, inclusive of Graviton and Trainium, is now over $10 billion in annual revenue run rate [...] Trainium is the majority underpinning of Bedrock usage today.”

The $10 billion milestone proves that Amazon’s vertical integration is a massive commercial reality. By offering a cost advantage, Amazon is creating a gravity well that makes it attractive for high-burn partners like OpenAI or Anthropic. The cheaper the compute, the stickier the ecosystem.

“On one end, you have the AI labs who are spending gobs and gobs of compute right now [...] And then at the other side of the barbell, you've got a lot of enterprises who are getting value out of AI in doing productivity and cost avoidance types of workloads.”

Jassy sees the AI labs as the immediate “anchor tenants” while waiting for the middle of the barbell (enterprise production workloads) to mature.

“Customers who used Rufus are about 60% more likely to complete a purchase. [...] Rufus can research products, track prices, and auto-buy, purchasing a product in our store when it reaches your set price.”

If agentic commerce increases conversion by 60%, the massive AI spend starts to pay for itself through the retail flywheel. Rufus is a high-velocity sales closer.

Total cloud infrastructure market spending grew by 30% Y/Y to $119 billion in Q4 2025, the ninth consecutive quarter of accelerating growth. Synergy Research Group projects growth above 20% for the next 5 years, with enterprise cloud services, social media, and search expanding.

AWS had a commanding 28% market share, compared to 21% for Microsoft Azure and 14% for Google Cloud.

What about margins? AI-driven CapEx and stock-based comp trimmed AWS margins by 2 points to 35%. Management had warned margins could fluctuate as AI investments flow through the P&L. AI is a short-term headwind on margin, but management expects the AI margin to match that of the non-AI business over time.

In recent months, Amazon’s satellite internet ambitions hit a regulatory bottleneck.

Rebrand to Amazon Leo: Amazon officially rebranded Project Kuiper to Amazon Leo in November, launching a public beta waitlist. The company aims to launch its service in 2026.

FCC Extension Request: Amazon just filed for a 24-month extension with the FCC. They are now asking for until July 2028 to meet the “half-constellation” milestone (1,618 satellites), citing a global shortage of heavy-lift rockets.

Production vs. Launch Gap: While Amazon has hundreds of flight-qualified satellites ready in their Kirkland facility, they only have roughly 180 satellites in orbit as of early 2026. This bottleneck is the primary risk to watch, though they have secured 10 additional Falcon 9 launches from SpaceX to bridge the gap.

Jassy explained:

“Leo will offer enterprise-grade performance [...] connecting directly to AWS. [...] we expect to launch commercially in 2026. We have dozens of commercial agreements already signed, including with AT&T.”

He’s pitching Leo as a specialized AWS feature rather than a consumer ISP. By bypassing the public internet, Amazon is creating a secure, space-based “private lane” for government and corporate data.

Amazon is moving beyond hosting models to pioneering “pre-training” as a service.

Custom models: Through Nova Forge, enterprises can bake their proprietary data into a model’s foundation at the start. Jassy calls these custom variants "Novellas." He likened the process to "teaching a child a language early in life," so it becomes part of their permanent learning foundation.

Move to action: With Nova Act, AWS is pivoting from providing models to providing autonomous agents. The goal is to move browser-based task reliability from 60% to 90%, turning Rufus (and enterprise bots) from search assistants into execution engines.

This is Amazon’s data moat. By building a Novella on AWS, an enterprise is anchoring its intellectual property to the Amazon ecosystem.

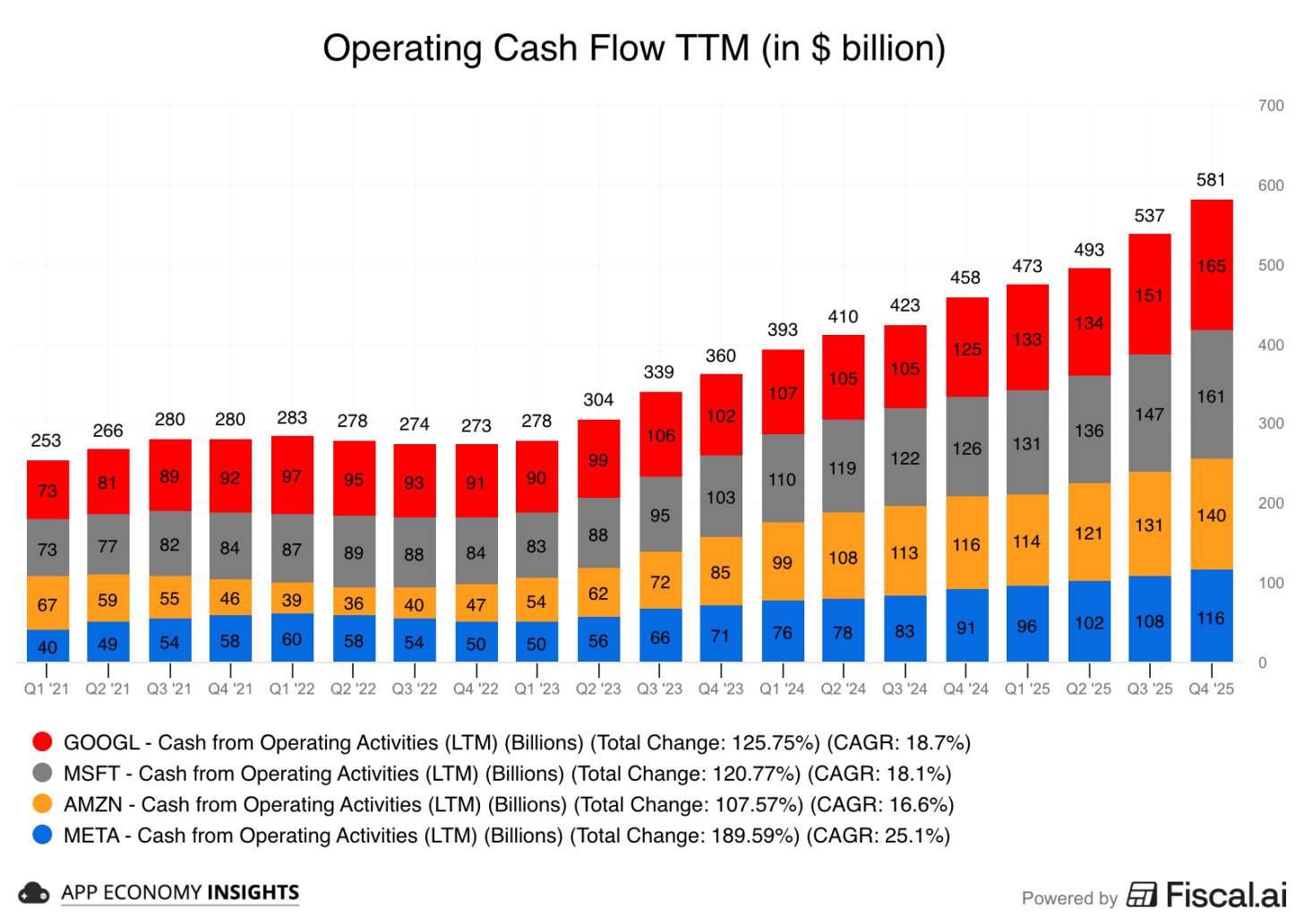

In short, Big Tech is using all the cash generated by current operations to invest in AI. Even Microsoft’s CapEx was nearly $73 billion in the past six months and will likely be far ahead of Wall Street’s estimates.

The chart below essentially shows the purchasing power of these giants. They can reinvest all of this into AI without raising external capital.

Amazon’s unique advantage has been its ‘Day 1’ posture, implying no buybacks or dividends. Every dollar is plowed into future growth. Now it’s possible the rest of Big Tech will adapt its capital allocation strategy to seize the moment.

No one is as aggressive as Amazon right now. They have proven time and again that reinvesting in future growth is money well spent.

With $200 billion lined up for FY26, the stakes and the potential rewards have never been higher. But it might be getting a little too hot, even for long-term-minded AMZN shareholders.

That’s it for today!

Stay healthy and invest on!

Thanks to Fiscal.ai for being our official data partner. Create your own charts and pull key metrics from 50,000+ companies directly on Fiscal.ai. Start an account for free and save 15% on paid plans with this link.

Disclosure: I am long AMZN, GOOG, and META in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with members.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.

2026-02-05 08:33:01

Welcome to the Premium edition of How They Make Money.

Over 280,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium members love our latest Earnings Visuals report!

Digest the performance of hundreds of companies in seconds.

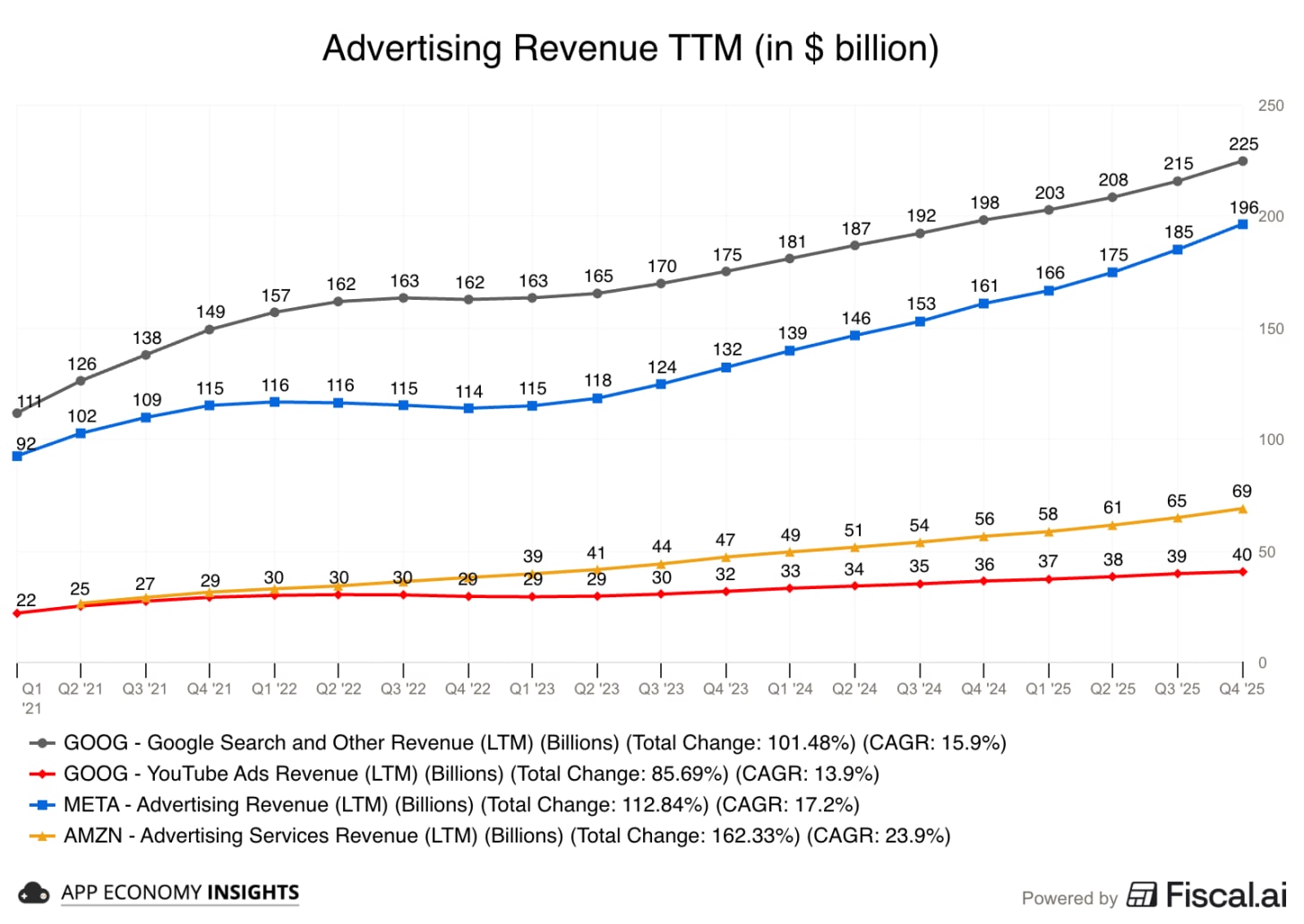

For the past year, Alphabet (GOOG) has been the quiet winner of the AI race. The stock doubled from its April lows, and the company recently crossed the $4 trillion valuation mark, edging past Apple for the first time since 2019.

The market is no longer asking if Google can build AI products. That assumption is already reflected in the soaring share price. Now we move to the execution phase.

CapEx ramp: Alphabet plans to spend up to $185 billion in CapEx in FY26, effectively doubling its 2025 level. The company is plowing back nearly every dollar generated by its existing operations into the AI race. While OpenAI and Anthropic are perpetually one down-round or one failed capital raise away from a crisis, Alphabet is funding the most expensive infrastructure build-out in history entirely through its own cash flows.

Cloud backlog surge: With a record $240 billion backlog (up 55% sequentially), how fast is GCP converting these contracts into recognized revenue? There’s also the TPU and Anthropic upside, which now includes processing 10 billion tokens per minute for API customers.

Agentic shift: Chrome’s new Auto Browse moves from Search to Action. With the Gemini app already hitting 750 million monthly active users, we look at the high-stakes business model shift from advertising to subscription.

Gaming flash-crash: Why did Genie 3 trigger a nearly $50 billion wipeout for gaming stocks like Unity and Roblox, and is the market reaction warranted?

Here’s what stood out this quarter.

Today at a glance:

Alphabet Q4 FY25.

Agents & virtual worlds.

Key insights from the call.

Chrome, Atlas, and antirust update.

Revenue grew +18% Y/Y to $113.8 billion ($2.3 billion beat).

🔎 Advertising: $82.3 billion (+14%).

Search: $63.1 billion (+17%).

YouTube ads: $11.4 billion (+9%).

Network: $7.8 billion (-2%).

📱 Subscriptions, platforms, and devices: $13.6 billion (+17%).

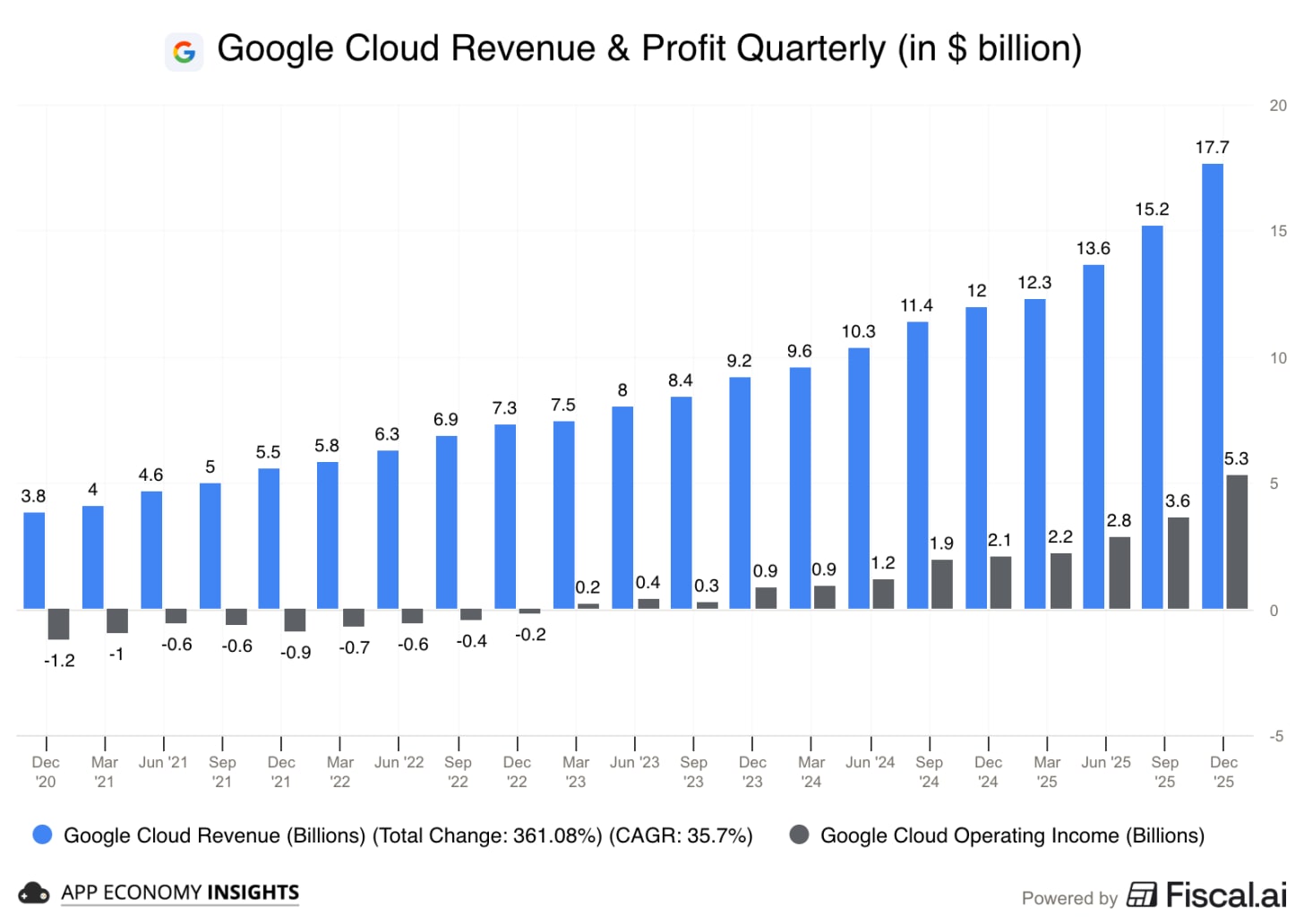

☁️ Cloud: $17.7 billion (+48%).

Margin trends:

Gross margin: 60% (+2pp Y/Y).

Operating margin: 32% (-1pp Y/Y).

Services (Advertising & Other): 42% (+3pp Y/Y).

Cloud: 30% (+13pp Y/Y).

Earnings per share (EPS) grew 31% Y/Y to $2.82 ($0.18 beat).

Operating cash flow was $52.4 billion (+34% Y/Y).

Free cash flow was $24.6 billion (-1% Y/Y).

Cash, cash equivalents, and marketable securities: $126.8 billion.

Long-term debt: $46.6 billion.

The $400 billion club: Alphabet officially surpassed $400 billion in annual revenue for the first time. In Q4, revenue growth accelerated from 16% in Q3 to 18% Y/Y in Q4. Net income surged 30% Y/Y to $34.5 billion. Note the $3.2 billion of “other income” primarily coming from unrealized gains from equity investments.

Search is an AI winner: Search accelerated 17% Y/Y to $63.1 billion. Sundar Pichai noted that Search usage is at an all-time high, with the launch of Gemini 3 driving an “expansionary moment” rather than the cannibalization that bears once feared. A good reminder that the market can be completely wrong for a long time.

YouTube’s $60 billion year: YouTube Ads grew only 9% Y/Y to $11.4 billion, partly impacted by a tough comp (US election year). While slower than Search, total YouTube revenue (including subscriptions) topped $60 billion for the full year, supported by a subscriber base that has now surpassed 325 million across all services.

Cloud is the primary engine: Cloud was the clear standout, growing 48% Y/Y to $17.7 billion (a massive acceleration from 34% Y/Y in Q3). The market expected Cloud to grow by 36%. The unit is now on a $70 billion annual run rate, and its operating income skyrocketed 154% Y/Y to $5.3 billion. This 30% segment margin demonstrates that AI infrastructure is a highly profitable business.

The $240 billion backlog: The Cloud backlog surged 55% quarter-over-quarter to $240 billion. Management emphasized “wide customer breadth.” This growth is a structural shift as enterprise customers move from experimenting with Gemini to signing billion-dollar, multi-year infrastructure deals. Anthropic is also likely a major contributor to the massive $85 billion sequential jump.

Other Bets cleanup: Other Bets revenue fell 7% to $370 million, with a widened operating loss of $3.6 billion. This included a one-time $2.1 billion charge related to Waymo employee compensation (more on Waymo in a minute).

CapEx shock: While 2025 spending hit the guided $91.5 billion, Alphabet stunned the market by guiding $175–$185 billion in CapEx for 2026. This is nearly double the 2025 level and well above the $120 billion analysts expected. Free Cash Flow for the quarter held steady at $24.6 billion, but the market is now anticipating most of it to go toward AI investments in FY26.

💡 Key takeaway: Alphabet is no longer playing catch up in AI. With Gemini models processing 10 billion tokens per minute via API and the Gemini app reaching 750 million monthly users, the tech is scaling at a pace that justifies the massive infrastructure spend. The company is trading short-term cash flow for a dominant, vertically integrated position in the AI era.

Alphabet is aggressively expanding the capabilities of its software and infrastructure.

In late January, Chrome launched its direct counter-offensive to OpenAI’s Atlas as we correctly predicted. Just as Meta has been piggybacking on innovations from other social platforms (from Stories to Reels), Google has been able to match features released from other AI labs.

Auto Browse (available for AI Pro and Ultra subscribers) transforms Chrome from a window into the web into an active participant within it.