2026-03-10 06:16:09

I’ve written a couple posts that reference the table below.

You could make a larger table, 6 × 6, by including sec, csc, cot, and their inverses, as Baker did in his article [1].

Note that rows 4, 5, and 6 are the reciprocals of rows 1, 2, and 3.

Returning to the theme of the previous post, how could we verify that the expressions in the table are correct? Each expression is one of 14 forms for reasons we’ll explain shortly. To prove that the expression in each cell is the correct one, it is sufficient to check equality at just one random point.

Every identity can be proved by referring to a right triangle with one side of length x, one side of length 1, and the remaining side of whatever length Pythagoras dictates, just as in the first post [2]. Define the sets A, B, and C by

A = {1}

B = {x}

C = {√(1 − x²), √(x² − 1), √(1 + x²)}

Every expression is the ratio of an element from one of these sets and an element of another of these sets. You can check that this can be done 14 ways.

Some of the 14 functions are defined for |x| ≤ 1, some for |x| ≥, and some for all x. This is because sin and cos has range [−1, 1], sec and csc have range (−∞, 1] ∪ [1, ∞) and tan and cot have range (−∞, ∞). No two of the 14 functions are defined and have the same value at more than a point or two.

The follow code verifies the identities at a random point. Note that we had to define a few functions that are not built into Python’s math module.

from math import *

def compare(x, y):

print(abs(x - y) < 1e-12)

sec = lambda x: 1/cos(x)

csc = lambda x: 1/sin(x)

cot = lambda x: 1/tan(x)

asec = lambda x: atan(sqrt(x**2 - 1))

acsc = lambda x: atan(1/sqrt(x**2 - 1))

acot = lambda x: pi/2 - atan(x)

x = np.random.random()

compare(sin(acos(x)), sqrt(1 - x**2))

compare(sin(atan(x)), x/sqrt(1 + x**2))

compare(sin(acot(x)), 1/sqrt(x**2 + 1))

compare(cos(asin(x)), sqrt(1 - x**2))

compare(cos(atan(x)), 1/sqrt(1 + x**2))

compare(cos(acot(x)), x/sqrt(1 + x**2))

compare(tan(asin(x)), x/sqrt(1 - x**2))

compare(tan(acos(x)), sqrt(1 - x**2)/x)

compare(tan(acot(x)), 1/x)

x = 1/np.random.random()

compare(sin(asec(x)), sqrt(x**2 - 1)/x)

compare(cos(acsc(x)), sqrt(x**2 - 1)/x)

compare(sin(acsc(x)), 1/x)

compare(cos(asec(x)), 1/x)

compare(tan(acsc(x)), 1/sqrt(x**2 - 1))

compare(tan(asec(x)), sqrt(x**2 - 1))

This verifies the first three rows; the last three rows are reciprocals of the first three rows.

[1] G. A. Baker. Multiplication Tables for Trigonometric Operators. The American Mathematical Monthly, Vol. 64, No. 7 (Aug. – Sep., 1957), pp. 502–503.

[2] These geometric proofs only prove identities for real-valued inputs and outputs and only over limited ranges, and yet they can be bootstrapped to prove much more. If two holomorphic functions are equal on a set of points with a limit point, such as a interval of the real line, then they are equal over their entire domains. So the geometrically proven identities extend to the complex plane.

The post Trig composition table first appeared on John D. Cook.2026-03-09 02:09:48

A couple weeks ago I wrote a post on a composition table, analogous to a multiplication table, for trig functions and inverse trig functions.

My initial version of the table above had some errors that have been corrected. When I wrote a followup post on the hyperbolic counterparts of these functions I was more careful. I wrote a little Python code to verify the identities at a few points.

Of course checking an identity at a few points is not a proof. On the other hand, if you know the general form of the answer is right, then checking a few points is remarkably powerful. All the expressions above are simple combinations of a handful of functions: squaring, taking square roots, adding or subtracting 1, and taking ratios. What are the chances that a couple such combinations agree at a few points but are not identical? Very small; zero if you formalize the problem correctly. More on that in the next post.

In the case of polynomials, checking a few points may be sufficient. If two polynomials in one variable agree at enough points, they agree everywhere. This can be applied when it’s not immediately obvious that identity involves polynomials, such as proving theorems about binomial coefficients.

The Schwartz-Zippel lemma is a more sophisticated version of this idea that is used in zero knowledge proofs (ZKP). Statements to be proved are formulated as multivariate polynomials over finite fields. The Schwartz-Zippel lemma quantifies the probability that the polynomials could be equal at a few random points but not be equal everywhere. You can prove that a statement is correct with high probability by only checking a small number of points.

The first post mentioned above included geometric proofs of the identities, but also had typos in the table. This is an important point: formally verified systems can and do contain bugs because there is inevitably some gap between what it formally verified and what is not. I could have formally verified the identities represented in the table, say using Lean, but introduced errors when I manually transcribe the results into LaTeX to make the diagram.

It’s naive to say “Well then don’t leave anything out. Formally verify everything.” It’s not possible to verify “everything.” And things that could in principle be verified may require too much effort to do so.

There are always parts of a system that are not formally verified, and these parts are where you need to look first for errors. If I had formally verified my identities in Lean, it would be more likely that I made a transcription error in typing LaTeX than that the Lean software had a bug that allowed a false statement to slip through.

The appropriate degree of testing or formal verification depends on the context. In the case of the two blog posts above, I didn’t do enough testing for the first but did do enough for the second: checking identities at a few random points was the right level of effort. Software that controls a pacemaker or a nuclear power plant requires a higher degree of confidence than a blog post.

Suppose you want to rigorously prove the identities in the tables above. You first have to specify your domains. Are the values of x real numbers or complex numbers? Extending to the complex numbers doesn’t make things harder; it might make them easier by making some problems more explicit.

The circular and hyperbolic functions are easy to define for all complex numbers, but the inverse functions, including the square root function, require more care. It’s more work than you might expect, but you can find an outline of a full development here. Once you have all the functions carefully defined, the identities can be verified by hand or by a CAS such as Mathematica. Or even better, by both.

2026-03-04 22:15:02

It is sometimes said that neural networks are “just” logistic regression. (Remember neural networks? LLMs are neural networks, but nobody talks about neural networks anymore.) In some sense a neural network is logistic regression with more parameters, a lot more parameters, but more is different. New phenomena emerge at scale that could not have been anticipated at a smaller scale.

Logistic regression can work surprisingly well on small data sets. One of my clients filed a patent on a simple logistic regression model I created for them. You can’t patent logistic regression—the idea goes back to the 1840s—but you can patent its application to a particular problem. Or at least you can try; I don’t know whether the patent was ever granted.

Some of the clinical trial models that we developed at MD Anderson Cancer Center were built on Bayesian logistic regression. These methods were used to run early phase clinical trials, with dozens of patients. Far from “big data.” Because we had modest amounts of data, our models could not be very complicated, though we tried. The idea was that informative priors would let you fit more parameters than would otherwise be possible. That idea was partially correct, though it leads to a sensitive dependence on priors.

When you don’t have enough data, additional parameters do more harm than good, at least in the classical setting. Over-parameterization is bad in classical models, though over-parameterization can be good for neural networks. So for a small data set you commonly have only two parameters. With a larger data set you might have three or four.

There is a rule of thumb that you need at least 10 events per parameter (EVP) [1]. For example, if you’re looking at an outcome that happens say 20% of the time, you need about 50 data points per parameter. If you’re analyzing a clinical trial with 200 patients, you could fit a four-parameter model. But those four parameters better pull their weight, and so you typically compute some sort of information criteria metric—AIC, BIC, DIC, etc.—to judge whether the data justify a particular set of parameters. Statisticians agonize over each parameter because it really matters.

Imaging working in the world of modest-sized data sets, carefully considering one parameter at a time for inclusion in a model, and hearing about people fitting models with millions, and later billions, of parameters. It just sounds insane. And sometimes it is insane [2]. And yet it can work. Not automatically; developing large models is still a bit of a black art. But large models can do amazing things.

How do LLMs compare to logistic regression as far as the ratio of data points to parameters? Various scaling laws have been suggested. These laws have some basis in theory, but they’re largely empirical, not derived from first principles. “Open” AI no longer shares stats on the size of their training data or the number of parameters they use, but other models do, and as a very rough rule of thumb, models are trained using around 100 tokens per parameter, which is not very different from the EVP rule of thumb for logistic regression.

Simply counting tokens and parameters doesn’t tell the full story. In a logistic regression model, data are typically binary variables, or maybe categorical variables coming from a small number of possibilities. Parameters are floating point values, typically 64 bits, but maybe the parameter values are important to three decimal places or 10 bits. In the example above, 200 samples of 4 binary variables determine 4 ten-bit parameters, so 20 bits of data for every bit of parameter. If the inputs were 10-bit numbers, there would be 200 bits of data per parameter.

When training an LLM, a token is typically a 32-bit number, not a binary variable. And a parameter might be a 32-bit number, but quantized to 8 bits for inference [3]. If a model uses 100 tokens per parameter, that corresponds to 400 bits of training data per inference parameter bit.

In short, the ratio of data bits to parameter bits is roughly similar between logistic regression and LLMs. I find that surprising, especially because there’s a sort of no man’s land between [2] a handful of parameters and billions of parameters.

[1] P Peduzzi 1, J Concato, E Kemper, T R Holford, A R Feinstein. A simulation study of the number of events per variable in logistic regression analysis. Journal of Clinical Epidemiology 1996 Dec; 49(12):1373-9. doi: 10.1016/s0895-4356(96)00236-3.

[2] A lot of times neural networks don’t scale down to the small data regime well at all. It took a lot of audacity to believe that models would perform disproportionately better with more training data. Classical statistics gives you good reason to expect diminishing returns, not increasing returns.

[3] There has been a lot of work lately to find low precision parameters directly. So you might find 16-bit parameters rather than finding 32 bit parameters then quantizing to 16 bits.

The post From logistic regression to AI first appeared on John D. Cook.2026-03-04 22:04:30

I was working with a colleague recently on a project involving the use of the OpenAI API.

I brought up the idea that, perhaps it is possible to improve the accuracy of API response by modifying the API call to increase the amount of reasoning performed.

My colleague quickly asked ChatGPT if this was possible, and the answer came back “No, it’s not possible to do that.” then I asked essentially the same question to my own instance of ChatGPT, and the answer was, “Yes, you can do it, but you need to use the OpenAI Responses API.”

How did we get such different answers? Was it the wording of the prompt? Was it the custom instructions given in the account personalization, where you describe who you are and how you want ChatGPT to respond? Is it possibly different conversation history? Many factors could have contributed to the different response. Unfortunately, many of these factors are either not easily controllable at the user level or not convenient to change to alternatives in a protracted trial and error search.

I’ve had other times when I will first get a highly standardized, generic answer from ChatGPT, even in Thinking mode, that I know is not quite right or just seems off. Then when I push back, I may get a profoundly different answer.

It’s simply a fact that large language models are conditional probabilistic systems that do not guarantee reproducibility in practice, even given the same inputs, even at temperature=0 [1]. Their outputs depend sensitively on prompt wording, context window contents, system instructions, and model configuration. Small differences in these inputs can yield substantially different outputs.

How well an AI chatbot responds can obviously have a massive impact on how effective the tool will be for your use case. Differences in responses could materially affect the outcome of your project. I take this as a wake-up call to be persistent, vigilant and flexible in attempts to obtain reliable answers from these new AI tools.

[1] (some) sources of nondeterminism: floating point / GPU nondeterminism, differing order of operations from distributed collectives, ties or near-ties in token probabilities, backend/infrastructure changes, model routing, hidden system prompt differences or tool availability.

The post An AI Odyssey, Part 2: Prompting Peril first appeared on John D. Cook.2026-03-03 10:40:22

I recently talked with a contact who repeated what he’d heard regarding agentic AI systems—namely, that they can greatly increase productivity in professional financial management tasks. However, I pointed out that though this is true, these tools do not guarantee correctness, so one has to be very careful letting them manage critical assets such as financial data.

It is widely recognized that AI models, even reasoning models and agentic systems, can make mistakes. One example is a case showing that one of the most recent and capable AI models made multiple factual mistakes in drawing together information for a single slide of a presentation. Sure, people can give examples where agentic systems can perform amazing tasks. But it’s another question as to whether they can always do them reliably. Unfortunately, we do not yet have procedural frameworks that provides reliability guarantees that are comparable to those required in other high-stakes engineering domains.

Many leading researchers have acknowledged that current AI systems have a degree of technical unpredictability that has not been resolved. For example, one has recently said, “Anyone who has worked with AI models understands that there is a basic unpredictability to them, that in a purely technical way we have not solved.”

Manufacturing has the notion of Six Sigma quality, to reduce the level of manufacturing defects to an extremely low level. In computing, the correctness requirements are even higher, sometimes necessitating provable correctness. The Pentium FDIV bug in the 1990s caused actual errors in calculations to occur in the wild, even though the chance of error was supposedly “rare.” These were silent errors that might have occurred undetected in mission critical applications, leading to failure. This being said, the Pentium FDIV error modes were precisely definable, whereas AI models are probabilistic, making it much harder to bound the errors.

Exact correctness is at times considered so important that there is an entire discipline, known as formal verification, to prove specified correctness properties for critical hardware and software systems (for example, the manufacture of computing devices). These methods play a key role in multi-billion dollar industries.

When provable correctness is not available, having at least a rigorous certification process (see here for one effort) is a step in the right direction.

It has long been recognized that reliability is a fundamental challenge in modern AI systems. Despite dramatic advances in capability, strong correctness guarantees remain an open technical problem. The central question is how to build AI systems whose behavior can be bounded, verified, or certified at domain-appropriate levels. Until this is satisfactorily resolved, we should use these incredibly useful tools in smart ways that do not create unnecessary risks.

The post An AI Odyssey, Part 1: Correctness Conundrum first appeared on John D. Cook.2026-03-03 00:08:49

In grad school I specialized in differential equations, but never worked with delay-differential equations, equations specifying that a solution depends not only on its derivatives but also on the state of the function at a previous time. The first time I worked with a delay-differential equation would come a couple decades later when I did some modeling work for a pharmaceutical company.

Large delays can change the qualitative behavior of a differential equation, but it seems plausible that sufficiently small delays should not. This is correct, and we will show just how small “sufficiently small” is in a simple special case. We’ll look at the equation

x′(t) = a x(t) + b x(t − τ)

where the coefficients a and b are non-zero real constants and the delay τ is a positive constant. Then [1] proves that the equation above has the same qualitative behavior as the same equation with the delay removed, i.e. with τ = 0, provided τ is small enough. Here “small enough” means

−1/e < bτ exp(−aτ) < e

and

aτ < 1.

There is a further hypothesis for the theorem cited above, a technical condition that holds on a nowhere dense set. The solution to a first order delay-differential like the one we’re looking at here is not determined by an initial condition x(0) = x0 alone. We have to specify the solution over the interval [−τ, 0]. This can be any function of t, subject only to a technical condition that holds on a nowhere-dense set of initial conditions. See [1] for details.

Let’s look at a specific example,

x′(t) = −3 x(t) + 2 x(t − τ)

with the initial condition x(1) = 1. If there were no delay term τ, the solution would be x(t) = exp(1 − t). In this case the solution monotonically decays to zero.

The theorem above says we should expect the same behavior as long as

−1/e < 2τ exp(3τ) < e

which holds as long as τ < 0.404218.

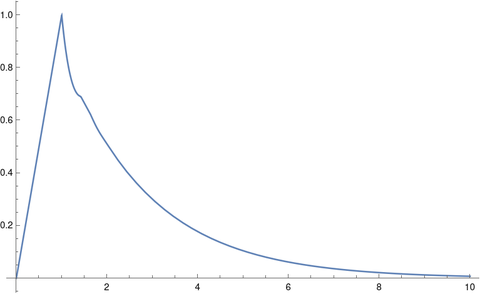

Let’s solve our equation for the case τ = 0.4 using Mathematica.

tau = 0.4

solution = NDSolveValue[

{x'[t] == -3 x[t] + 2 x[t - tau], x[t /; t <= 1] == t },

x, {t, 0, 10}]

Plot[solution[t], {t, 0, 10}, PlotRange -> All]

This produces the following plot.

The solution initially ramps up to 1, because that’s what we specified, but it seems that eventually the solution monotonically decays to 0, just as when τ = 0.

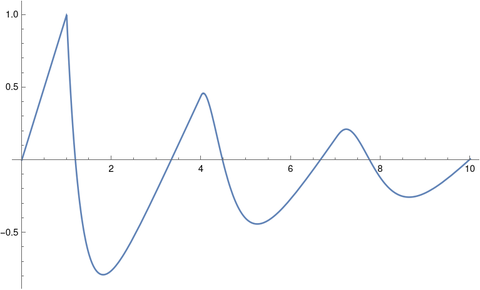

When we change the delay to τ = 3 and rerun the code we get oscillations.

[1] R. D. Driver, D. W. Sasser, M. L. Slater. The Equation x’ (t) = ax (t) + bx (t – τ) with “Small” Delay. The American Mathematical Monthly, Vol. 80, No. 9 (Nov., 1973), pp. 990–995

The post Differential equation with a small delay first appeared on John D. Cook.