2026-01-30 00:59:20

Another $30B from SoftBank. Up to $30B from NVIDIA.1 Maybe more than $20B from Amazon. Several billion from Microsoft. Yes, OpenAI is back out there with the tin cup extended to bring in a few more bucks to build the future of AI.

The numbers, as relayed in two different stories, one from The Information and the other from The Financial Times, are sort of all over the place. But that's undoubtedly because the exact amounts are all still moving targets. Regardless, it's pretty clear that OpenAI is going to hit their $100B goal, and that they can probably raise even more if they choose to. And given that this raise is coming just months after finally and formally closing the then-staggering $40B fundraise, they probably should...

2026-01-29 03:38:29

If I mention the situation swirling around Tim Cook right now and the film The Dark Knight in the same sentence, your mind probably immediately goes to one scene in the movie. Cook, for all the great things he's done over his time as CEO of Apple – a tenure which is longer than Steve Jobs' time leading the company – is now in the position where many see him as a villain. At least of this particular narrative. But actually, that scene, which I often reference, including about Apple, is not the one I'm thinking about here...

2026-01-28 20:21:20

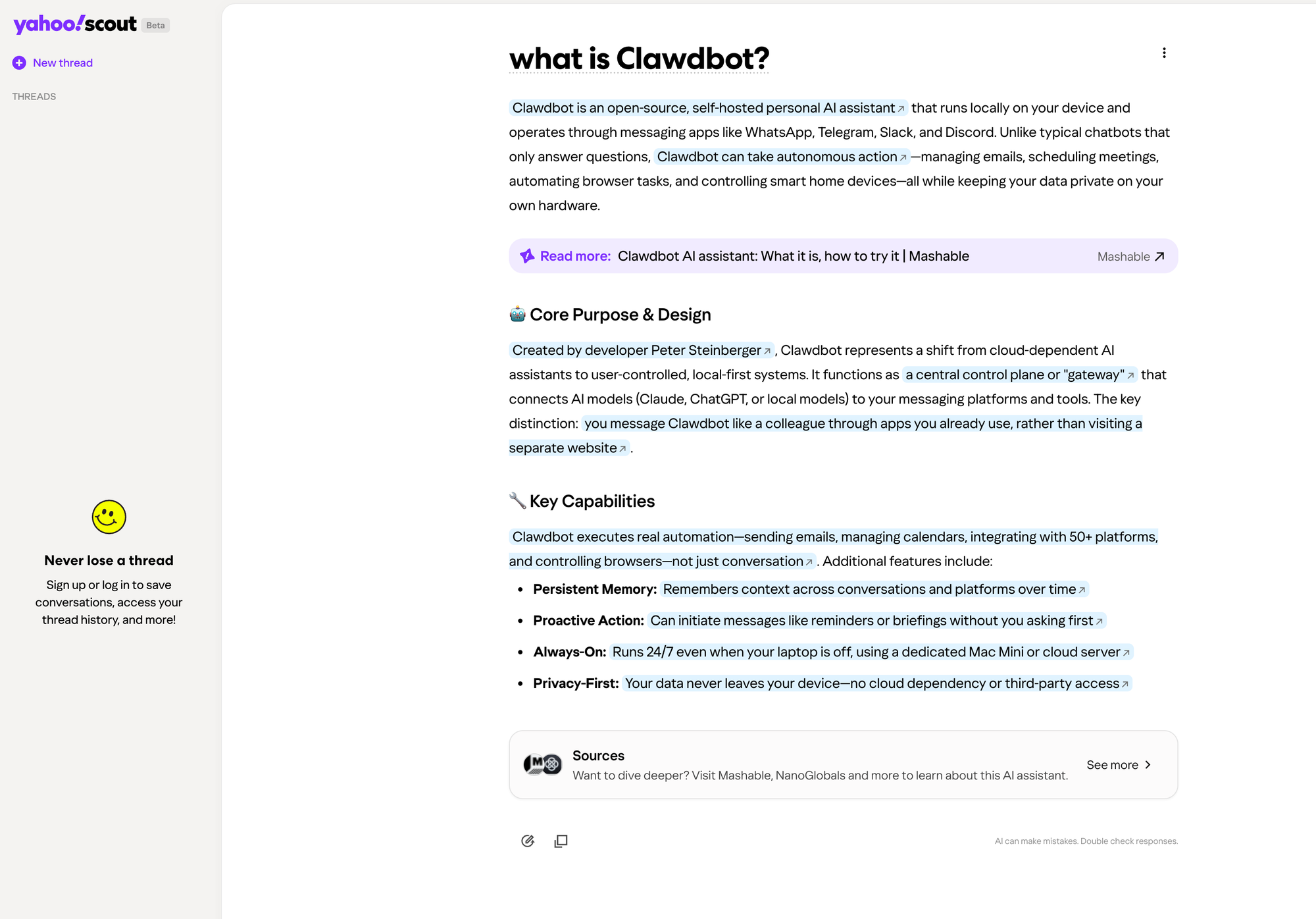

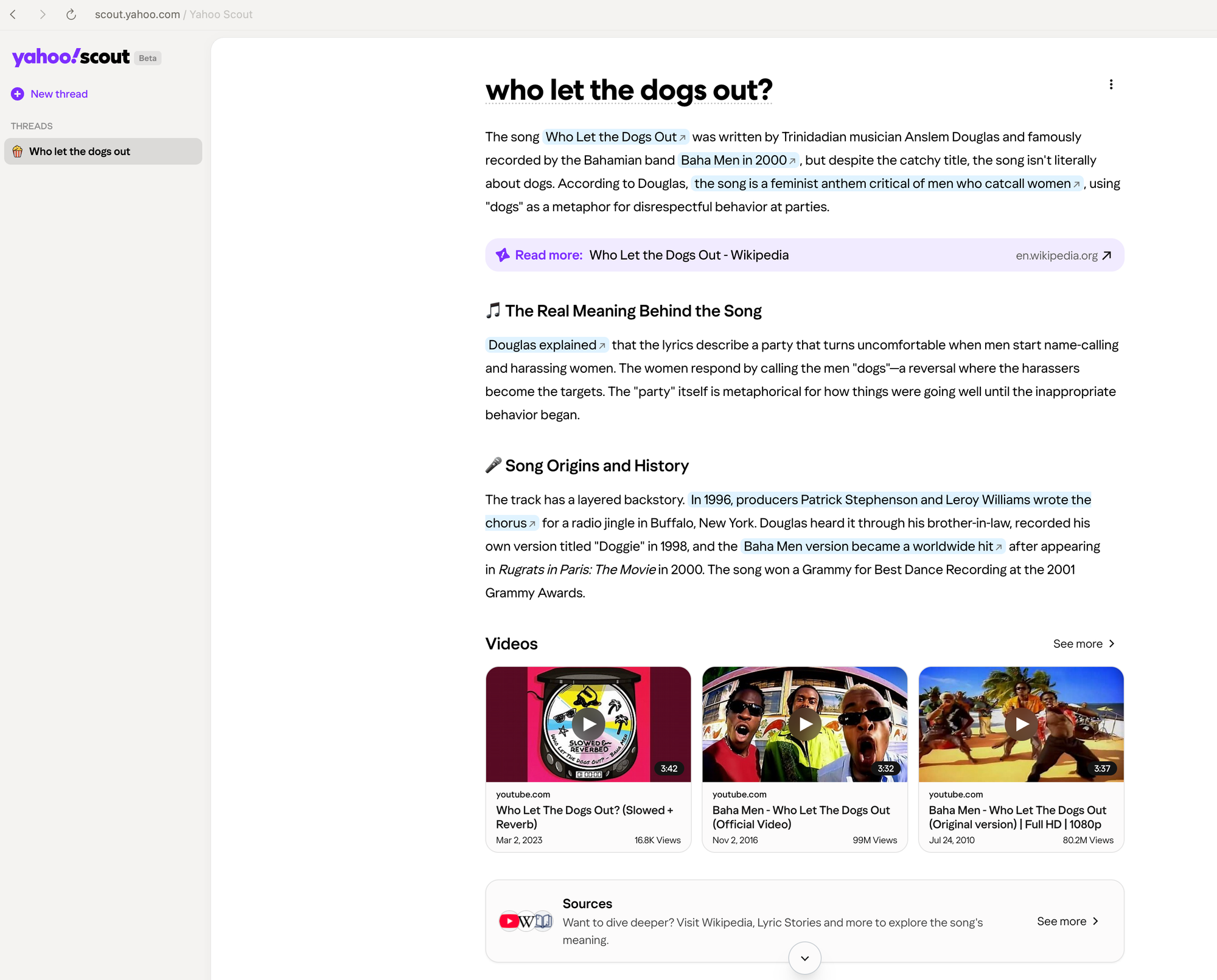

One sort of odd thing about our current AI chatbot revolution: every service looks basically the same. Beyond the textbox, the outputs for ChatGPT, Gemini, Claude, and the like are mostly just a stream of words with some light formatting for better legibility. Well, I suppose Claude's responses are more beige, quite literally, so there's that. You get why they've all coalesced around this same basic template, and yet there's also clearly some room for improvement. I just didn't expect it to come from Yahoo!1

Yahoo’s big AI play is, in many ways, actually a return to the company’s roots. Three decades ago, Yahoo was known as “Jerry’s guide to the world wide web,” and was designed as a sort of all-encompassing portal to help people find good stuff on an increasingly large, hard-to-parse internet. In the early aughts, the rise of web search more or less obviated that whole idea. But now, Yahoo thinks, we’ve come back around.

With a new product called Scout, Yahoo is trying to return to being that kind of guide to the web — only this time, with a whole bunch of AI in the mix. Scout, in its early form, is a search portal that will immediately be familiar if you’ve ever used Perplexity or clicked over to Google’s AI Mode. It shows a text box and some suggested queries. You type a question; it delivers an answer. Right now Scout is a tab in Yahoo’s search engine (which, CEO Jim Lanzone likes to remind me every time we talk, is somehow still the third-most-popular search engine in the US), a standalone web app, and a central feature in the new Yahoo Search mobile app. Yahoo calls it an “answer engine,” but it’s AI web search. You get it. And so far, it’s the most search-y of any similar product I’ve tried. I like it a lot.

Trying Scout out for the past couple of days, I actually like it quite a lot too! Beyond simply spiffying the outputs up with the use of more color (and emojis), the way they handle links feels a bit better too – rather than being citation-style at the end of blurbs, they're more hyperlink-style, flowing with the text. I could see why some might like this less – visually, it breaks up the reading flow a bit – but I find it decidedly more web-native. As such, I suspect it will lead to a lot more clicks out, back to that web.

And while it also feels a bit weird for Yahoo to be the one pushing new boundaries (or, I suppose, restoring some old boundaries, in a way), it also makes some sense both given their history – which put them in position to still be "the third-most-popular search engine in the US" – and the fact that they do own and control a bunch of still highly-used products with unique data sets: Yahoo Sports, Finance, Weather, etc. If the big AI players are creating more of a canvas for what replaces web search, Yahoo is sort of doing what web search would look like if it was built around AI.

Even "AI Mode" within Google feels more like shoving Gemini – a full-on "native" AI experience in line with its peers – into Google Search. This feels different. Maybe even a bit better?

And this old/new UI might even work a bit better when it comes to monetization? Again because I think it will entice more people to click. In other words, it could help the old monetization methods remain intact, or at least in a better position than the other AI players, which I think will need to figure out new formats and methods of measuring new metrics that matter.

One thing Yahoo isn’t doing? Building its own foundation model. For one thing, Lanzone says, doing that is very expensive. “We think we can best serve our users not so much with the model,” he says, “but with the grounding data and the personalization data that we can add on top of other people’s models.” Scout is based on Anthropic’s Claude model, and what Feng describes as “Yahoo content, Yahoo data, Yahoo personality.” Much of the web-search data comes from a partnership with Microsoft and Bing, as it has for many years.

That could also help Yahoo here in the long run if and when those models become more commoditized. And they already have the experience of outsourcing the "core" work in Search to Microsoft, as noted. Of course, that reliance on Claude (and still Bing) could come back to bite if Yahoo is really just a wrapper around AI and Search.2 What's the moat there beyond brand-awareness and maybe some of that smaller proprietary data from their own services? The long-term play would have to be to use that small moat to lever into a bigger one on the back of better monetization. But it's just way too early to know if and how that will play out.

Still, kudos to Yahoo here. Scout is a fun attempt to think a bit differently about AI results, while in many ways, thinking about the past.

1 Exclamation and all! ↩

2 Still, Bing couldn't get Google to dance, could Yahoo?! ↩

2026-01-28 03:14:45

A year ago, the world changed. On January 20, 2025, DeepSeek released their 'R1' model and within a week, the burgeoning AI Bubble had burst and as a result, NVIDIA's share price plummeted. This, in turn, brought down the entire stock market. We entered a new era of "AI Winter" where cheap, open-source models replaced the insanely-expensive-to train-closed variety from OpenAI, Anthropic, and others. China, in a way, had won.

That, of course, is not what happened.

The "DeepSeek Moment" ended up as more of a hiccup. A "Sputnik Moment" that sputtered. Well, that's not exactly fair. Because it was still an important moment, but more of a teaching one in that it was in part a bit of a wake up call and another part a gut check. But not exactly a moment that changed everything.

I suspected as much at the time, noting a couple days later:

On Monday, just before the markets opened, I did an "emergency pod" with Alex Kantrowitz for his Big Technology podcast around this news. Beyond the initial reactions, I think we hit on a lot of what is now playing out. And actually, about 34 minutes in, we start to talk about what I suspect is the ultimate takeaway from all of this: DeepSeek's real fallout may have less to do with DeepSeek the company/model/product and more to do with the wake up call it provided to those powers that be.

Said another way, everyone seemed to be locked into the notion of scaling that we were blinded to any other possible way of doing things. Even if DeepSeek is embellishing just how much money and compute was required to create their models, it doesn't really matter. The reaction from the stock market down to the startups has made it abundantly clear that there's room here to think differently about how to approach the continued build out of AI.

To be clear, NVIDIA's stock did collapse on that day exactly a year ago. The 17% drop wiped out about $600B in market cap, which remains the all-time record. But within a couple of weeks, the stock had largely bounced back, though it remained depressed until the Summer, when the fallout had fully cleared and NVIDIA became the first $5T company. That drop, as it turns out, was simply a buying opportunity.

A couple of weeks after DeepSeek's moment, things were more clear still:

Really, looking over all of these and taking a step back: is anything all that different than it was before DeepSeek detonated two weeks ago? Not really! Again, it’s just a mentality shift that has taken place across all of these sectors and companies. That’s undoubtedly a good thing — it’s always good to pause and revisit your strategy — but it’s not clear just how much will ultimately change in the long run. It's worth questioning that too!

Is Europe going to win in AI now? Are more startups going to succeed? Is Big Tech going to spend less? Is OpenAI going to raise less? The answers here are obviously not going to be black and white, but my point is that you could certainly make the case that nothing much actually changed as a result of DeepSeek in the longer term. And again, that’s largely because it just really highlighted what was always going to happen anyway.

What everyone was seeking is what was already seeking them. Deep, I know.

While Lina Khan and others – including Sam Altman and Satya Nadella – were busy trying to fit DeepSeek into their own narratives the reality was just far more nuanced. Though, as I argued at the time, really, so was Sputnik itself:

So again, I go back to the notion that DeepSeek itself matters less than what it inspires. Maybe what we really hope for here is that it simply sped up progress, even just a bit, clearing heads and roadblocks. While the notion of this being a "Sputnik moment" is now being played up as hyperbolic, perhaps it's better to simply read it literally. When the Russian satellite launched in late 1957, the US was already close to space. In fact, were it not for some trepidation and bureaucracy, many believe that we could have gotten there first. It was a kick in the ass, not a fundamental rethinking of everything. Sometimes, that’s all you need. It lit a fire that stayed lit through a trip to the moon. Back to work.

I bring this up both because it has been a year, but also because DeepSeek is on the verge of releasing their long-awaited next flagship model. 'V4' should be here in a matter of weeks. You can tell this not just from the reporting on the matter, but also the fact that both Alibaba and (the Alibaba-backed) Moonshot AI pushed out their own new models this week, clearly to get ahead of DeepSeek.

To be clear, 'V4' won't be a direct follow-up to 'R1', but instead to 'V3', which was the model released in December 2024 that laid the groundwork for their reasoning model breakthrough. It's unclear when 'R2' is coming – given all the delays, it's entirely possible that it's baked right into 'V4' – but it's also unclear it matters now. All eyes will be on just how close DeepSeek's flagship model can get to the top models – the focus is seemingly on coding. And, of course, how they trained it. Again, the true breakthrough a year ago.

The first post I actually wrote about the company was on that day because it was also when DeepSeek's app had shot to the top of the App Store charts, supplanting ChatGPT. A year later and the app is outside of the Top 500, at least in the US App Store. ChatGPT is back at the top.1

Yet DeepSeek still matters, just in a different way. Beyond the way it was trained, it has helped China secure a lead in "open source" models – especially once Mark Zuckerberg decided to shoot Llama in the head and start over. Much of the rest of the world seems happy to have cheaper, more extensible alternatives to the big model makers. You know, just in case.

But again, where exactly China is in the "AI Race" is the subject of much debate at the moment. While some in China are saying that they're still lagging behind the leading US firms – and that perhaps the chasm is growing – Mistral's Arthur Mensch said this was a "fairy tale" last week in Davos. Google DeepMind's Demis Hassabis was less certain, saying that the cutting edge of the Chinese AI work was still six months behind the US. The new DeepSeek release will presumably clear this up a bit...

But not entirely because obviously the US and China are still going back and forth and then back and forth again over exactly which NVIDIA chips – if any – will be allowed to be legally shipped into the country. Any legally sanctioned sales will obviously be a huge boon to NVIDIA's business, as they have basically written that business down to zero. It will also, of course, oddly help the US Treasury as they get a cut of those would-be sales.

China's lesson from DeepSeek would seem to be that the restraints placed around AI forced their companies to innovate to catch up faster. And their clear hope would be that this will work with AI chips as well, as it will force Huawei and others to try to catch NVIDIA, faster. At the same time, China probably can't afford to sit back and let their companies fall behind if that strategy doesn't work.

Never mind that a lot of these companies can simply train models in other countries using NVIDIA chips that are not two generations old. There are still a lot of moving pieces on the board...

And that includes back in the US, where a growing number of players are starting to think beyond LLMs. Many now believe that achieving AGI, let alone "Superintelligence", will require at least a few new breakthroughs. While others believe it will be impossible to make robots fully work without "World Models" – which is obviously a focus in China as well, where a different type of AI bubble may have formed...

Anyway, we'll see what, if any, deep impact DeepSeek has with a new year and new model. But I'll give the last words to Hassabis, who was chock full of good quotes at Davos last week: "I think it was a massive overreaction in the West."

1 Though it risks being taken down by a social network called UpScrolled which is surging on the back of TikTok's sale to US investors and concerns that there's already content moderation going on – cue Alanis Morissette. ↩

2026-01-26 19:48:51

Tim Cook is captured. There is simply no other explanation for his actions over the past year or so. But it perhaps culminated this weekend when Cook went to a special private showing of the documentary Melania at the White House. Yes, that Melania. That in and of itself would have probably been fine. I mean, it's potentially problematic for a host of reasons that I'll get to, but such is our world right now. Then one shot – a gunshot – turned attending that movie screening into a statement...

While Cook was enjoying his popcorn and champagne with the likes of Mike Tyson, Tony Robbins, and other "VIPs", it was complete and utter chaos on the streets of Minnesota. Just hours earlier, Alex Pretti, a 37-year-old ICU nurse, was shot and killed by ICE agents. Maybe, just maybe, postpone the movie premiere?

Of course, President Trump was never going to do that because the official White House stance is that Pretti was a "domestic terrorist" and the agents were acting in self defense. And never mind that this was the second such murder in the past 17 days, the show must go on!

But it didn't have to for Cook. He could have, and should have, backed out of the event. Obviously. The fact that he didn't either suggests horrible judgement on his part or worse, cowardice. This is a man and leader of one of the biggest and most important businesses in the world who had long been thought to have a great moral compass.

He has lost his way.

I would say he has also lost his mind, but from a pure business perspective, you can see how he would try to justify this. It's gross, but it is what it is.

Apple, perhaps more so than any other company needs to maintain a working relationship with Trump. Because Trump has clearly zeroed in on Apple and Cook in particular, as his own personal rag doll. This is in part because Apple is one of the most valuable companies in the world and arguably the best known, certainly from a consumer-perspective. But it's also in part Cook's own fault, as he's made it clear that he would bend over backwards to work with Trump to benefit Apple – which has worked at times – dating to the first administration. But if you give a mouse a golden trinket...

Anyway, all of this means that Cook must stay in Trump's good graces. He has already learned this "lesson" once, the hard way, when he turned down going on tour with Trump to be trotted out as a human trophy. As a result, Cook, and by extension, Apple, were thrown right back under the tariff bus.

With that context, going to a movie premiere may seem like relatively low-stakes. But the situation changed with the situation in Minnesota unfolding in real time. I mean, Jesus Fucking Christ. Read the room. Or the news. Or even just a tweet.

Cook, clearly terrified of Trump, could have said he had a cold. He could have said anything. Instead, there he was being photographed with director Brett Ratner.1

Of course, Cook was not alone at this event.2 There were a few other business leaders, most notably Andy Jassy, the CEO of Amazon. But he also had a direct business reason for being there, albeit a seemingly ridiculous one in that Amazon produced the reported $75M (!) movie. Did I mention this was a documentary? But costs tend to balloon when you're paying a reported $28M to the subject of the documentary. Amazon's offer was apparently 3x the next closest one... Yes, this was essentially Jassy's version of Cook's gold trinket gift to Trump. Albeit a far more expensive and elaborate one!

Anyway, that's why Jassy (and Amazon MGM head Mike Hopkins) were on hand. They should have backed out too, but at least there's a business excuse, I guess. What's Cook's rationale here? Again, beyond being a captured man?

In this light, you can almost see why he wouldn't want to retire from the Apple CEO role anytime soon. Not because he enjoys or even wants such power, but, giving him some benefit of the doubt here, because he doesn't want to subject anyone else at Apple to such tasks.3 Perhaps best to wait out the Trump administration, or at least until after the midterms, when you don't have to squint now to see tech starting to turn against Trump as he creeps upon lame duck status...

For now, the embarrassment will continue for Cook. The harming of an otherwise outstanding legacy at Apple sold not for a song, but for a movie ticket.

Update January 28, 2026: Tim Cook has now addressed the situation, in the briefest of ways possible, in a memo to Apple employees. While calling for a "deescalation" – which mirrors President Trump's own words – the clear point of the memo is to suggest that Cook used his time with Trump this week to have a "good conversation with the president".

Was that before or after the credits rolled on the movie screening? Cook does not directly address the event itself, which is of course the problem here.

Update January 28, 2026: Some further thoughts on what Tim Cook and Apple could be thinking here – no matter how misguided...

1 One has to wonder what the star of Apple TV's Your Friends and Neighbors, Olivia Munn, thinks about that... ↩

2 Given everything going on with NVIDIA and chip sales to China, I wouldn't have been shocked to see Jensen Huang there. But he was busy... in China. Where was Zuck? You could have seen him jumping at such an invite. Maybe upset that the FTC is appealing their antitrust loss? ↩

3 Could you imagine John Ternus, in his first week on the job, having to go kiss Trump's ring? He has other things to worry about... ↩

2026-01-25 04:48:27

Reading all the posts about Kathleen Kennedy's (drawn-out) exit from Lucasfilm,1 handing over the reins of the Star Wars universe to Dave Filoni (and technically, Lynwen Brennan – but Filoni for creative purposes),2 they all sort of dance around the big question: where is he going to take it? They all note the work that's already well underway or in the pipeline, but they're all tangential elements at best. What everyone really wants to know is: when and how he'll do the next Star Wars trilogy?

Because it's obviously coming. It has to be. You don't give someone the power at Lucasfilm and not let them continue the main stories that everyone cares most about. It would be like taking over Nintendo and never doing another Mario game.

And Filoni, famously, was hired and mentored by George Lucas himself before he sold Lucasfilm to Disney. And Filoni wasn't a production/operations person like Kennedy, he was a full-on creative, cutting his teeth in animation and screenwriting. He must be champing at the bit to continue what Lucas started...

At the same time, he's also well known to be in-the-weeds when it comes to Star Wars. Perhaps (and probably) too much. That has worked with a lot of the animation projects because those are both less mainstream and in a way, animation gives you cover to try more things.

Disney had previously announced that the first live-action Star Wars movie that Filoni would direct would be a cross-over between The Mandalorian, The Book of Boba Fett, Ahsoka, and The Skeleton Crew – all Disney+ series – but Kennedy clearly back-burnered it in favor of this summer's Mandalorian & Grogu movie (co-written by Filoni but directed by Jon Favreau). And that was undoubtedly a smart move. While The Mandalorian has been a hit, the other three are bigger question marks. Releasing a feature film relying on knowledge from each of those shows was potentially a recipe for disaster. Better to stick with what works and throw in a sweetener by putting Grogu – aka "Baby Yoda" – right there in the title and marketing.3

So the question now is if Filoni will be able to make such calls without Kennedy around to check his tendencies. And to be clear and fair, Kennedy clearly had her own tendencies which could have used some checking over these past many years.

Beyond Solo, which she's taking a new round of flack for in the press with the retirement cycle – FWIW, I didn't think it was awful, just totally unnecessary – there was Obi-Wan, which was sloppy and almost tedious. And The Acolyte, which was legitimately bad at points. And that one points back to a Filoni concern in a way because the driving force there, Leslye Headland, was also clearly an in-the-weeds nerd for this stuff. Before the show hit, I wondered if that might be a problem and well, it was.

Which brings it back to Star Wars, the main timeline and trilogies. Again, it's clearly going to happen. Beyond Filoni taking over Lucasfilm, Disney itself is also on the verge of getting a new CEO. That person is clearly going to want to/need to play the new Star Wars trilogy card at some point. The question is how Filoni approaches and handles it...

Does he try to take them on himself? Perhaps bringing in some of the ideas Lucas passed on to Disney (perhaps written up to juice the sale price) at the time of sale? A couple elements made it into Episodes VII, VIII, and IX, but for the most part, everything was thrown out. It does seem like Filoni is on the verge of restoring some of those plot points with the forthcoming Maul – Shadow Lord show. Yes, another animated series for Disney+. As the title implies, it centers around yes, Darth Maul. Yes, after his – 27 year spoiler alert! – mauling by Obi-Wan Kenobi in Episode I. And yes, continuing on from what was teased in – 8 year spoiler alert! – Solo. And yes – spoiler for the animated series – The Clone Wars and Rebels too. Or maybe this new series is simply a way to wink to those Lucas ideas for 'Darth Talon' and whatnot.

Does Filoni view the Simon Kinberg project(s) as the potential continuation of the main cannon? They're still being written – "very good, but not there" to quote Kennedy herself – but the plan was said to be for three movies... Lucasfilm apparently pushed back on the notion in the past that these would be a continuation of the Skywalker Saga but there's some fuzziness there. And again, it's a work very much in progress...

Then there's the new Rey movie, which would obviously be a continuation of the Saga, but apparently wasn't intended to be the start of the next trilogy and more just an offshoot. But no one knows since not only is it not written, it has seemingly been in pre-production hell for years now without a clear status.

Does Filoni (re)approach Steven Soderbergh and Adam Driver to resurrect their Ben Solo sequel which Kennedy apparently liked but Disney itself cut down? Taika Waititi's take is still clearly top of mind for him, but sounds... different. Could next year's Starfighter evolve into something more...

There are clearly a lot of options, but the best one may be to keep it simple and just write a series of sequels to The Rise of Skywalker. Luke is gone. Leia is gone. Han is gone. But we're getting to the point that there may be some nostalgia building for the newer characters that remain – at least from The Force Awakens. Get a great writer in there, perhaps a fresh set of eyes, Tony Gilroy-style.4 Focus on the characters and a good story. Decent dialog is pure icing on the cake in this universe.

Yes, maybe somehow, Ben Solo can return. Snoke? Plagueis? Brad Bird? Colin Trevorrow?! Just, for the love of god, not Palpatine.5

1 I didn't realize that she got her start as Spielberg's assistant – technically the assistant as someone who worked in the same building as Spielberg and he poached her! To its credit, that is often how Hollywood works! ↩

2 As expected/predicted... ↩

3 And even then, it's far from a sure thing this will be a huge hit – and I suspect that's exactly why they're leveraging Baby Yoda in the title and marketing, he's the viral hit. But that was also a long time ago... ↩

4 Perhaps the biggest concern with Dave Filoni going forward in this role is the report he apparently disliked Andor, undoubtedly the best bit of Star Wars content in years. ↩

5 Also ideally not Robert Downey Jr. ↩