2026-02-02 23:26:06

图片系AI生成

2026年的中国车市,以一种近乎分裂的姿态拉开帷幕。

一边是主流车企的高管们在年初的战略会上意气风发,将销量目标数字高高挂起,同比增长动辄30%、50%,甚至67.5%;另一边,车企们拿出的1月成绩单——环比普降两成、三成甚至近五成,仅有少数玩家维持着体面的同比正增长。

开局的数据冷静得近乎残酷。根据乘联会的数据预测,狭义乘用车零售约180万辆,环比猛跌20.4%,同比仅微增0.3%。同时,新能源渗透率从高位回落至44.4%。

政策退坡的靴子落地,消费前移的透支效应显现,春节的消费节奏被打乱,一切迹象都指向一个词:调整期。

车企们并非看不懂市场信号。中国汽车工业协会预测全年增长1%,瑞银、摩根大通甚至给出了下滑的预期。然而,与机构的审慎保守形成刺眼反差的,是主流车企们集体喊出的、一个比一个激昂的销量目标。

据不完全统计,目前11家已公开目标的车企,其2026年销量总和高达2380万辆,相比它们2025年2000万辆的总成绩,同比增幅达19%。若将比亚迪、上汽、广汽、理想等未公开目标的巨头基数计入,2026年头部车企的总销量目标将直指3547万辆。

那么,车企们明知山有虎,为何偏向虎山行?

在汽车行业高度金融化的今天,增长速度是维持估值、获取融资的生命线。一个保守的目标会被市场解读为增长乏力。因此,我们看到零跑汽车在59.66万辆的基础上,直接喊出100万辆的年度目标,增幅高达67.5%;小米汽车将目标定为55万辆,同比增幅约34%;蔚来则坚持每年40%至50% 的增速预期。

对于尚未盈利或利润微薄的新势力而言,喊出高增长,就是向投资人承诺:故事还在继续,空间依然巨大。即便是传统巨头,如长城汽车定下180万辆(增长36%)的目标,东风集团剑指325万辆(增长超30%),其超出行业平均预期的增幅,同样是为了在资本市场和舆论场上抢占“高成长”的有利身位。

更深层的原因,是行业洗牌进入深水区后的“求生本能”。罗兰贝格等机构反复预警:淘汰赛正在加速。未来的市场格局,将是“几家头部、几家中部、大量尾部”。此时不奋力一搏、挤进更安全的梯队,就可能永远失去机会。高目标是一剂强心针,也是内部动员令。

长安汽车在一场内部大会上宣布330万辆的目标(增长13.3%),奇瑞瞄准320万辆(增长14.03%),北汽定下220万辆(增长25.57%),无不是逼着全公司从研发、生产到销售都进入“战时状态”,去挖掘每一丝潜在增长。相比之下,一汽(354.6万辆,增长7.39%) 与吉利(345万辆,增长7.66%) 的目标虽显“谨慎”,但其绝对量级本身已是对其体系能力与市场地位的宣示。

这不是盲目乐观,而是背水一战。

然而,当2026年1月的销量数据陆续揭晓,市场的另一面悄然浮现。与目标的“热”形成鲜明对比的,是开局的“冷”。

传统车企的牌桌正在重新洗牌。吉利意外地以27万辆登顶,同比增长1%,环比增长14%,其关键在于“两条腿走路”:新能源销量(含吉利银河品牌、领克品牌、极氪品牌)达124252辆,同比增长约3%。新能源产品结构进一步优化,极氪1月销量达23852辆,同比翻倍增长;国外,出口量销量60506辆,同比大幅增长121%,有效对冲了内需疲软。

而曾经的王者比亚迪,则陷入了“战略性调整”的阵痛。21万辆的销量背后,是同比30%的下滑。但深入看,这更像一次主动的“重心转移”:王朝、海洋网等走量系列收缩,但方程豹、仰望等高端系列却增长惊人;国内销量承压,出口占比却已逼近50%,海外成了第二主场。

奇瑞凭借“出口单腿”站稳了脚跟。 20万辆的销量中,近60%来自海外,使其相对绝缘于国内市场的寒潮。但这同时暴露了隐忧:过度依赖出口使其暴露于全球贸易与地缘政治的风险之下,国内品牌与新能源转型的力度,尚未能支撑起同样强劲的增长。子品牌的全线下跌,定位高端的星途品牌同比下滑9.1%,而专注于新能源的 iCAR品牌下滑56.5% 以及与华为合作的 智界品牌同样出现断崖式下滑。

腰部车企选择“激进突围”,而尾部玩家已清晰感受到淘汰赛的寒意。 长城汽车凭借出口和硬派越野等差异化市场维持增长,但新能源转型的滞后仍是悬顶之剑。东风试图通过奕派等新能源子品牌实现“换道超车”,增速惊人但基数尚小,且传统合资板块的萎缩仍在持续。至于北汽蓝谷等,个位数的增长在行业巨变中已显得力不从心;极石汽车虽增速耀眼,但月销千辆且严重依赖中东单一市场,在国内竞争的牌桌上,筹码已所剩无几。

最精彩的戏剧发生在“新势力”舞台。这里上演着“新贵崛起,老将分化”的戏码。鸿蒙智行1月交付量达5.79万辆,同比增长65.6%,尽管环比下滑35.3%,但依然稳居新势力。“五界”当中仍然是问界一支独秀,单月交付40016台,同比增长83%,占鸿蒙智行整体交付量的69.1%。

小米汽车的表现也颇为亮眼,1月交付量超3.9万辆,虽较2025年12月的5万余辆环比下滑22%,但在SU7新老切换、主力交付车型转为YU7的背景下,依然稳居新势力前列。

传统“蔚小理”阵营的分化则尤为明显。蔚来凭借高端化布局实现高速增长,1月交付2.72万辆,同比增长96.1%,其中全新ES8单月交付约1.76万辆,成为绝对销量支柱,占总交付量的64.7%。

理想汽车则陷入阶段性调整,1月交付2.77万辆,同比下滑7.55%,成为“蔚小理”中唯一同比下滑的企业,核心原因是电池供应短缺导致纯电车型产能爬坡滞后,此前依赖的增程车型优势逐渐减弱,面临产品周期与市场竞争的双重压力。小鹏汽车表现最弱,1月交付2.01万辆,同比下滑34.07%,环比下滑46.6%,产品迭代节奏与智能驾驶技术落地速度未能跟上市场节奏,增长陷入瓶颈。

在头部剧烈交锋的同时,中部阵营的生存空间正被快速挤压。零跑、岚图等品牌虽有增长,但已明显身处第二梯队,冲击头部的窗口正在收窄。零跑汽车1月交付3.2万辆,同比增长27%,但环比下滑46.9%,虽实现同比正增长,但面临需求透支后的增长压力,其2026年冲击百万辆的目标面临不小挑战;岚图汽车1月交付1.05万辆,同比增长31%,计划2026年推出4款新车,试图通过产品迭代实现突破。

这场分化告诉我们一个残酷事实:车市的增长不再是雨露均沾。消费者的注意力与钱包份额,正快速向拥有核心技术、鲜明品牌或生态优势的玩家集中。马太效应,从未如此强烈。

2026年的这个开局或许只是季节性波纹,但同比分化的裂痕,却可能贯穿全年。对于车企而言,那个靠一款车、一个概念、一波流量就能快速崛起的草莽时代正在终结。

可以预见,接下来的月份里,我们将看到更为猛烈的市场攻势。新车发布将空前密集,营销创新会层出不穷,渠道战争蔓延至三四线乃至县域市场,金融工具被用到极致。一切只为撬动那看似停滞的需求,将目标拉近现实。

同时,行业整合的暗流将更加汹涌。正如艾睿铂预测,大量月销低于千辆的品牌将难以为继。资源将加速向产品力强、资金雄厚、战略清晰的头部企业聚集。一些企业的宏伟目标或许无法完全实现,但这个过程本身,就是一场残酷而有效的市场筛选。

对于消费者而言,这或许是一个“买方市场”的好时代。更卷的竞争意味着更优质的产品、更实惠的价格和更优的服务。但对于车企,这无疑是一场关乎生存与尊严的硬仗。

最终,2026年的故事,不会仅仅是目标数字是否达成的简单评判。它更将检验车企在战略定力、运营效率、技术储备和风险抵御上的综合能力。那些能在激进目标与务实经营之间找到最佳平衡点,既能仰望星空描绘增长蓝图,又能脚踏实地穿越市场周期的企业,才能在这场漫长的淘汰赛中,笑到最后。

车市大幕已启,好戏,还在后头。

(文|引擎视角 作者|韩敬娴 编辑|李玉鹏)

更多精彩内容,关注钛媒体微信号(ID:taimeiti),或者下载钛媒体App

2026-02-02 20:43:20

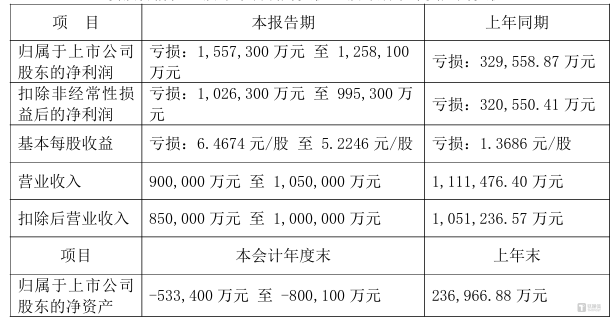

1月30日,深康佳A(000016.SZ)披露2025年度业绩预告,预计归母净利润亏损125.82亿至155.73亿元,亏损规模较上年同期大幅扩大,期末净资产预计由正转负至-53.34亿元至-80.01亿元,这意味着公司在2025年年报披露后大概率要披星戴帽。

本次巨亏核心源于大规模资产计提减值带来的“财务大洗澡”,叠加消费电子业务低迷拖累。2025年华润入主后,已推动管理层换血、业务聚焦等改革,此次百亿预亏或为“刮骨疗毒”第一步,但深康佳A能否逆转颓势,仍有待观察。

深康佳A此次业绩预告堪称触目惊心。数据显示,2025年预计归母净利润亏损125.82亿至155.73亿元,同比扩大281.7%至372.8%;扣非净利润预计亏损99.53亿至102.63亿元,同比大幅扩大;营业收入预计90亿至105亿元,同比下滑5.5%至19.0%。更为严峻的是,期末归母净资产预计为-53.34亿至-80.01亿元,触及退市风险警示规定,年报披露后大概率被冠以“*ST”字样。

据公告解释,百亿巨亏源于两大核心因素,其中大规模资产计提减值是主导,消费电子业务疲软则雪上加霜。2025年,公司基于谨慎性原则,对存货、应收账款、股权投资等多项资产大额计提减值并确认预计负债,规模较往年大幅提升,被市场解读为华润入主后的主动“财务大洗澡”。

消费电子业务的持续疲软同样不容忽视。2025年,该业务因产品竞争力不足营收下滑,虽费用有所压降,但毛利仍无法覆盖费用,持续亏损。作为核心主业,康佳彩电曾连续5年登顶销量冠军,2010年后因产品创新不足、品牌影响力下滑,市场份额持续萎缩。2025年行业需求疲软、竞争加剧,其产品未能形成差异化优势,进一步加剧整体亏损压力。

更为严峻的是公司不断恶化的财务结构。2025年前三季度,公司资产负债率已攀升至96.78%,创下历史新高。回顾近三年,这一指标持续攀升:2022年为77.74%,2023年升至83.51%,2024年进一步达到92.65%。

高负债率背后是巨大的偿债压力。截至2025年前三季度,公司货币资金与交易性金融资产合计仅45亿元,而短期借款高达59亿元,一年内到期的非流动负债为42亿元,长期负债还有50亿元,长短期负债合计高达151亿元。

经营活动产生的现金流量净额为-10.86亿元,呈现净流出状态,表明公司主营业务的造血能力持续不足。2025年前三季度,公司利息费用就达到5.39亿元,相当于每天支付近200万元利息。

即便华润入主后提供了39.7亿元低息借款,年化利率仅3%,一定程度上降低了财务成本,但未能从根本上缓解公司的财务压力。此次财务大洗澡虽然清理了部分历史包袱,但公司当前的财务状况依旧严峻。

百亿预亏背后,是深康佳A从辉煌到衰落的无奈,更是华润入主后推动改革的决心。作为老牌彩电企业,康佳曾书写行业辉煌,但因战略模糊、多元化转型失败,陷入业绩承压、转型维艰的困境。

康佳的衰落始于多元化转型的迷失。1992年上市后,其业绩快速增长,彩电业务长期位居行业前列,但2001年首次出现亏损后,盈利能力持续下滑。为摆脱困境,康佳开启多元化布局,涉足白电、半导体、环保、工贸等领域,却陷入盲目扩张陷阱——半导体业务未达规模化产出,环保、工贸等业务成为财务包袱,资产负债率高企至96.78%,2011至2024年扣非净利润累计亏损超百亿,转型举步维艰。

2025年,央企专业化整合为深康佳A带来转折点。华润集团于4月启动股权划转,7月完成A、B股全部过户,持有30%股份成为新控股股东,华侨城结束34年控股历史。

华润入主后,首要举措是管理层全面洗牌。2025年8月,康佳换届产生新一届董事会,华润系占据4席非独立董事,邬建军当选董事长,余惠良任财务总监,华润系主导决策层。此后,总裁曹士平、副总裁杨波先后辞职,华润背景的董钢出任副总裁,进一步强化华润话语权。

业务聚焦与资产优化是另一项核心改革。早在2023年,华润就提出退出工贸、环保等非主业,聚焦消费电子与半导体。2025年华润入主后,加快业务优化步伐,通过资产减值剥离低效资产,集中资源投向核心主业。从业务协同看,华润在消费电子、半导体等领域的资源布局,能为康佳提供供应链、技术等支持,助力其提升产品竞争力、突破半导体业务瓶颈。

二级市场上,投资者态度谨慎。2月2日,深康佳A开盘即封死跌停,截至收盘,深康佳A报4.48元/股,市值107.88亿元。

此次百亿预亏对康佳而言,既是危机也是转机。华润加持下的“刮骨疗毒”能否实现绝地翻盘,关键在于其能否在有限时间内,将央企资源转化为产品竞争力与财务稳健性。改革从来不会一蹴而就,对于已有数十年历史的深康佳A而言,留给它逆转颓势的时间,可能已经不多了。(文|公司观察,作者|周健,编辑|曹晟源)

更多精彩内容,关注钛媒体微信号(ID:taimeiti),或者下载钛媒体App

2026-02-02 19:56:55

图片系AI生成

周末“山雨欲来”之后,暴跌在“黑色星期一”如期上演。

2日午后,黄金、白银价格继续深度下探。现货黄金跌破4500美元/盎司,日内下跌7.5%。现货白银跌幅一度超14%,抹平近一个月涨幅。国内商品期市午盘大面积收跌,沪银、钯、铂跌停,沪金跌11.68%;基本金属全部下跌,沪锡跌停;能源品、黑色系、化工品纷纷跟跌。

A股市场上,贵金属、有色板块亦大面积重挫,中金黄金(600489.SH)、四川黄金(001337.SZ)、白银有色(601212.SH)、豫光金铅(600531.SH)等股大面积跌停。黄金股ETF、黄金股票ETF开盘跌停,国投白银LOF今日复牌后一字跌停,场内情绪急剧冰冻。

肉眼可见的是,前期获利盘集中了结,杠杆资金被强制出清,过热的投机情绪遭到“暴力纠偏”。“前期看涨仓位过度拥挤,在突发消息冲击下,负向反馈机制被迅速激活,技术性抛压集中释放,最终形成踩踏式下跌。” 南华期货分析师夏莹莹指出。

中金公司最新发布的研究报告分析亦称,金价显然已超越单纯的基本面主导,传统的黄金测算模型如实际利率已失效。

继1月深圳水贝市场人满为患、金店排队抢购之后,史上最强的技术性回调到来。

上周五,贵金属市场率先上演“血色星期五”:黄金遭遇40年来最大下跌,白银创出历史最大盘中跌幅。其中,现货黄金价格一度下跌超过12%,最低触及4682美元/盎司,为1980年代初以来最大单日跌幅。现货白银一度暴跌超过36%,创出历史最大日内跌幅,最低下探至74.28美元/盎司。

2日,国内期货市场全线大幅低开,恐慌情绪在盘中持续蔓延,从贵金属到有色金属再到能源化工,多品种接连触及跌停板。截至收盘,沪银、铂、钯、沪铜、沪铝、沪镍、沪锡、铝合金、碳酸锂、国际铜、不锈钢、原油、燃料油等13个品种集体跌停,市场遭遇“黑色星期一”。

其中,沪金期货主力合约一度触及跌停,最低触及1005.4元/克,收盘打开跌停,跌幅为15.73%,创该品种上市以来最大跌幅。至此,黄金、白银、铜等有色品种,2个交易日就将过去一个月的涨幅都跌去,波动之剧烈相当罕见。

数据显示,黄金14天RSI指标在1月28日突破90,为本世纪以来首次,显示极度“超买”。1月29日白银波动率指数升至111,刷新历史新高。财通证券认为,前期价格极速上涨是由逼仓叠加期权伽马挤压效应助推的,一旦情绪反转,去杠杆过程异常惨烈。

此外,机构观点表示:

和盘面一致“惨绿”不同,暴跌之后的机构观点呈现分歧——对短期走势普遍谨慎,但对中长期前景的分歧正在拉大。

部分期货及量化机构认为,此前金银价格上涨过快、涨幅过大,短期涨势明显透支,杠杆资金高度拥挤,一旦价格反转,清算链条很难在一两天内完成,短期“二次探底”的风险仍然偏高。

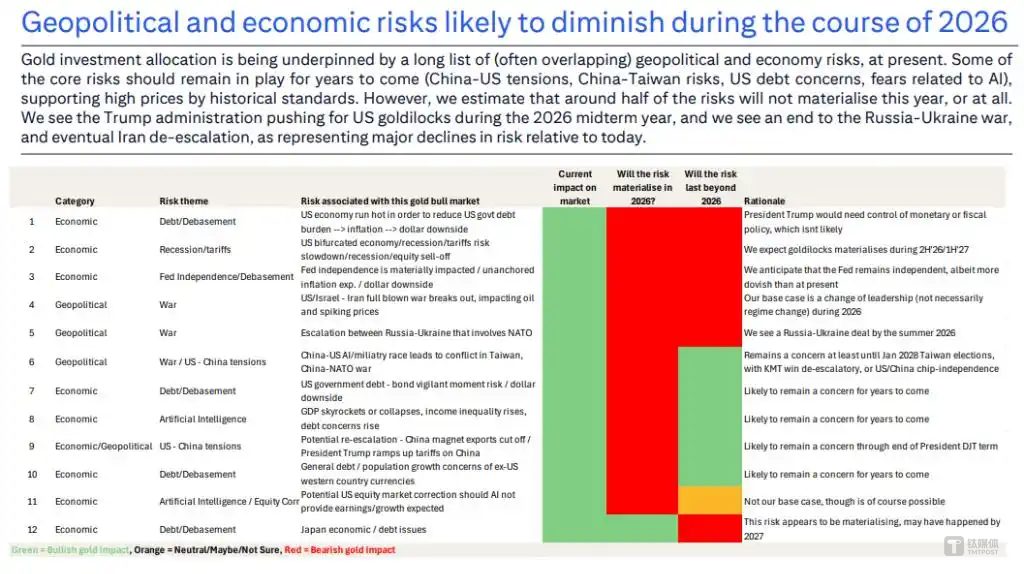

花旗亦在1月30日的最新大宗商品研报中警告:金价支柱面临坍塌,“当前的黄金价格已严重透支了未来的不确定性,估值已达到极端水平”,全球黄金支出占GDP比例飙升至0.7%,为55年来最高。若黄金配置比例回归0.35%-0.4%的历史常态,金价将面临“腰斩”风险。 该行全球大宗商品主管Maximilian Layton认为,虽然短期内金价仍有冲高可能,但其估值已达到“极端水平”。随着2026年下半年避险情绪的集体消退(俄乌冲突有望达成协议、美国经济上行及美联储独立性确认),支撑金价的“支柱”可能面临结构性坍塌。

同时,黄金面临着最脆弱的时刻。据花旗测算,仅需5%的获利盘出逃,就足以抵消全球实物需求,对市场造成巨大冲击。花旗研报维持0-3个月目标价5000美元/盎司不变,但对2026年下半年持谨慎态度,基准情景预计金价将在2027年回落至4000美元/盎司。

而摩根大通基本金属与贵金属策略主管Gregory C. Shearer领导的分析团队则表示,维持对黄金的中期看涨观点,并预测在央行购金和投资者需求的推动下,金价将在2026年年底达到每盎司6300美元。

方正证券综合推演后认为,若要贵金属牛市逻辑彻底逆转,需同时满足多项严苛条件(如全球生产力迅速革命、沃什强力推行紧缩且未扰乱市场、央行购金需求消退等),这一情景发生概率极低。

综合来看,机构分歧已经从“涨不涨”,转向“能涨多久、怎么涨、谁来涨”的层面。(文 | 公司观察,作者 | 黄田,编辑 | 曹晟源)

更多精彩内容,关注钛媒体微信号(ID:taimeiti),或者下载钛媒体App

2026-02-02 19:46:31

文 | 电厂,作者 | 董温淑,编辑 | 高宇雷

经过为期一周的预热,2月1日腾讯元宝App新春活动正式上线。

当天零点,为期3天的首轮抽红包活动开放。用户最初是卡点涌进元宝App,抢夺第一波红利。随着零点刷新的抽取机会用尽,分享得次数的传统裂变玩法上阵。

同一天,元宝的AI群聊社交功能“元宝派”开始公测。微信群、元宝派,乃至各大社交平台都开始被红包口令刷屏。

元宝新春红包落地页,图源/元宝App

10亿元的“钞能力”,让万千用户“愿者上钩”。元宝App在几个小时内,被推上iOS Store免费榜第一的位置。而这轮活动只是前菜,此后还有分别各为期6天的两轮红包活动,一直延续到春节午夜12点。

但是仅仅在活动开始数个小时的2月1日,铺天盖地的分享链接已让用户不胜其烦,电厂数个微信群已经置顶禁止分享红包的规定。

对微信体验的冲击、未来的用户留存,这些伴随增长而来的问题,仍没有解决答案。

从1月底开始,元宝接连推出两大破圈举措,先是在1月25日,腾讯官方发布《关于春节分10亿现金的通知》,宣称单人抽取红包“最高可得万元”;1月26日,元宝App内新功能“元宝派”开始内测,试水AI群聊社交。

2月1日,两大举措同时“开闸”,伴随红包首轮开抢,元宝派也正式开启公测。

而元宝红包的慷慨手笔,的确让不少用户直呼“上头”。北京用户蕾然告诉「电厂」,在几个小时内,她已抢到了43元多的红包金额。

具体玩法方面,活动期间,每位用户每日0点,可自动刷新出5次抽取机会,通过完成任务还能额外获得40次以上的抽取机会。

奖池中除了数额不等的现金红包,还设有红包膨胀卡、额外的分享红包次数、QQ音乐/美团券等联合权益,以及限量100张的万元“小马卡”。截至成文,已有24位用户抽到了小马卡。

在小红书、抖音、微博等社交平台,均可见用户通过分享链接、拉起“互助群”,来号召网友下载App友情互点。甚至有鸿蒙手机用户因暂时无法下载适配系统的元宝App,而在小红书分享专属的抢红包攻略。

同期“元宝派”也进入公测,用户可通过邀请码开通“派”功能,在App内加入群聊,不少有尝鲜心理的用户也由此开始下载元宝。当前,不少元宝派内也已被红包链接刷屏。

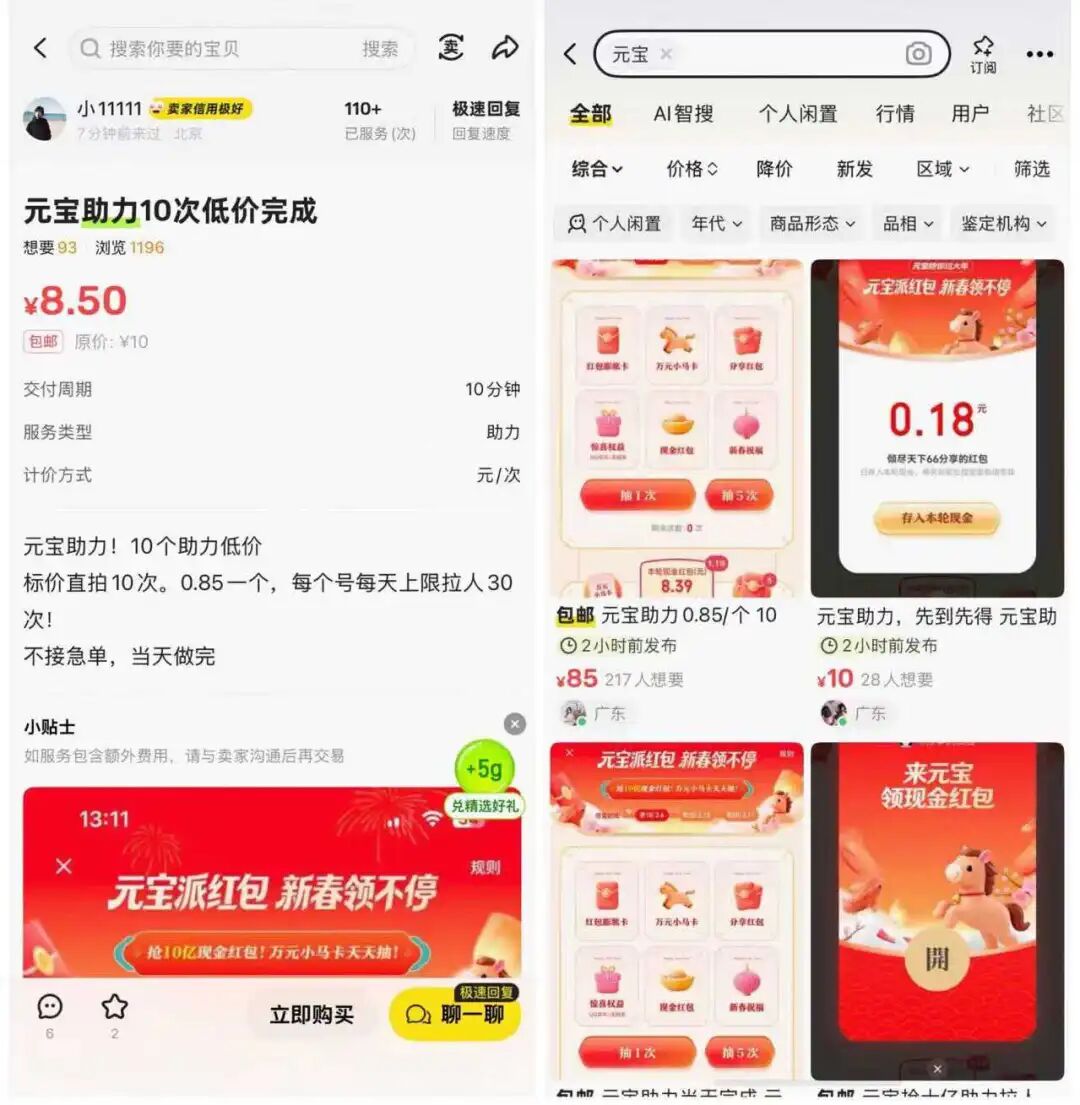

当朋友圈熟人和“为爱发电”的陌生人点击已无法满足需求,部分用户开始寻求付费点击。

「电厂」注意到,已有人开始在二手交易平台闲鱼上兜售“真人点击分享链接”的服务。单次点击定价在0.7、0.8、0.85元不等,其中有商品链接显示“已服务110+(次)”。

元宝红包帮点服务,图源/闲鱼

相较用户对红包的错失焦虑,元宝在这个新春季的紧迫感只多不少。对它而言,想要逆转数月来落后友商的局面,这是难得的反超机会。

2025年2月春节后,元宝通过接入当时爆火的DeepSeek完成了一场冷启动,并凭嵌入微信等举措引起关注,一度冲上App下载榜首。但在此后几个月间,伴随豆包、灵光、蚂蚁阿福、千问等新旧App的一轮轮刷屏,元宝的存在感逐渐减弱。

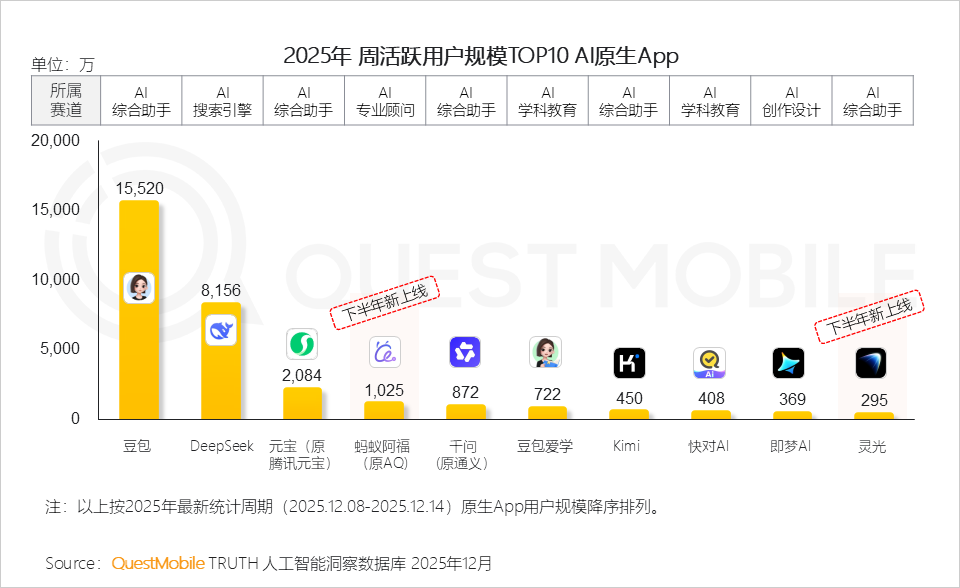

据QuestMobile调研数据,在2025年12.08-12.14的统计周期中,豆包、DeepSeek、元宝AI原生App榜单前三,但周活跃用户数差异较大,分别为1.55亿、8156万、2084万。换言之,元宝的规模优势还不算稳固。

图源:QuestMobile

又一年春节来临,这个国人全年社交互动的“顶点时刻”,对拥有微信、QQ两大社交生态的元宝而言将是绝佳的增长窗口。

除了分享得抽取次数,元宝还缝合了各类体验得次数的玩法。比如,当用户用固定模版生成春节海报、趣味图片,或是与元宝聊天、体验DeepSeek新功能,就能获得一定的抽取次数。

而元宝派内,元宝Agent以群内助手的形式存在,可以通过艾特行为唤出,完成设置定时任务、P图、总结文章内容等功能。此外,用户还可在派内共享屏幕、一起听歌/看视频等。

凡此种种,都在短时间内让元宝的创作功能用量直线上升。不难看出,元宝希望凭借为期半个月的红包举措,让用户能够每日登录,并沉淀为用户习惯

在百度从事运营工作的Shirley告诉「电厂」,在其看来,元宝的这轮操作“迅猛而蓄谋已久”。“春节活动每家都有,不算稀奇,但我没想到元宝开始得这么早。”她讲道。

在元宝发力后,百度、阿里也迅速筹措资源,开始跟牌。

1月25日,与元宝红包活动规则发布同日,百度官宣5亿元红包计划。官方信息显示,自1月26日至3月12日,用户在百度App使用文心助手就有机会分5亿现金红包,单个红包最高可达1万元。

千问App则在2月2日早10点官宣将投入30亿元,进行免单活动与发放大额红包,活动计划在2月6日正式开启。

短短几天之内,春节红包就被改造成了AI应用们拉新的“斗兽场”。

除了红包雨,对AI群聊、聊天室的布局也不可或缺。

1月26日元宝派功能内测上线后,仅一天后的1月27日,百度在文心App中紧急推出“多人、多Agent”群聊功能,并强调这一功能早在1月16日就已开始内测,为行业首推。

百度文心AI群聊中提供“群聊助手”“专属文心助手”“文心健康管家”等多个Agent角色。并且相较元宝派中元宝需要由用户艾特唤起的设计,文心AI群聊中的助手们能够主动关注群内消息和提供建议。不过据「电厂」实际体验,相较元宝派,当前文心AI群聊功能用户还不算多。

文心App上线群聊功能,图源/文心App

另一边,据“读佳”1月26日报道,阿里也已面向少量深度用户,在旗下UC浏览器中内置“AI群聊”功能,内设原生智能AI助手“小优”、夸克AI、通义千问,以及Deepseek四个助手角色。

目前,豆包暂未下场,但也未缺席这场流量争夺赛。字节跳动旗下火山引擎已官宣成为2026年央视春晚的独家AI云合作伙伴,智能助手豆包也将配合上线多种互动玩法。

巨头接连下场,一切都只开了个头。可以想见接下来半个月中,各家将激烈争夺。如开源证券传媒行业首席分析师方光照分析称:“国内大模型厂商不断通过高频模型迭代升级、模型的性价比优势及海外扩张提升用户和收入规模,并借助全年最盛大的节日——春节的系列活动所带来的强社交裂变效应,加码争夺C端AI入口。”

而这让用户喜闻乐见,有网友调侃:“之前都是给AI工具花钱,这还是第一次用AI赚钱。”

但热火朝天的流量收割战终将结束,到那时C端AI应用们还将面临各自的问题。

2014年春节开始,微信率先掀起春节红包首秀,开启了与支付宝在春节节点的三年红包大战。直至2016年12月28日,腾讯集团高级执行副总裁、微信事业群总裁张小龙明确表示,这一年春节不再有微信红包营销活动。

彼时他讲道:“微信刚刚启动的时候,通过微信红包能够带动更多人使用。”而在微信成为日常使用工具后,“摇一摇”红包的历史使命就已完成。

而AI原生应用们离日常使用工具还有不小的距离。在微信春节红包“功成身退”10年之后,这个老手段又被当做了“元宝们”的杀手锏。

但在当新春红包季落幕后,元宝、千问、文心App还能靠什么来黏住用户?这还是一个待解的问题。

2月1日当天元宝App冲上iOS Store免费榜第一,图源/iOS Store

以元宝为例,据「电厂」在不同派中观察,当前元宝派中的用户活跃度并不算高。在多数元宝派中,都是由不同用户发起对话,元宝“一对多”、多线程地展开对话,尚未达到理想的“陌生人社交”“网络聊天室”效果。

而除了“一起看”功能外,P图、文章总结等功能也可以通过直接与元宝对话实现。

而另一面,微信生态中铺天盖地的红包分享链接也已让不少用户感到烦扰,并引发对腾讯“双标”、对元宝链接“炸群”不作为的质疑。

“太打扰人了,有人在我的群里发红包链接,我就会把他/她踢出去。”不少人表达了类似的厌倦情绪。

更多精彩内容,关注钛媒体微信号(ID:taimeiti),或者下载钛媒体App

2026-02-02 19:45:04

文 | 医曜

收购传闻发酵半个月后,默沙东还是中止了对于Revolution的收购。此前的交易案中,默沙东拟以280亿至320亿美元的价格收购“RAS新贵”Revolution,这一价格仅次于当年辉瑞对Seagen的收购。

尽管收购未能落地,但这场天价并购的背后,已然透露出 “旧王” 默沙东的战略野心。在双抗逐渐成为市场热点的当下,默沙东决不能坐以待毙。Revolution 虽暂无商业化产品落地,但其核心管线已交出亮眼临床数据,有望开创 RAS 抑制剂赛道的全新格局。

在核心药物 Keytruda (K药)专利悬崖日益逼近的背景下,默沙东亟需一场重磅战略并购,稳固并延续其在免疫治疗(IO)领域的统治地位。

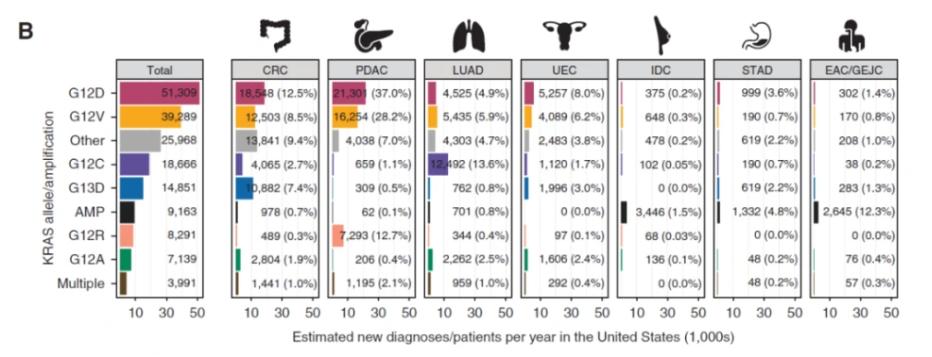

作为人类癌症发展进程中极为常见的驱动因素,全球范围内约30%的人类肿瘤与RAS基因突变相关。其中,约30%-50%的结直肠癌患者、15%-20%的非小细胞肺癌患者以及90%的胰腺癌患者存在KRAS突变阳性情况。

图:美国新确诊癌症患者KRAS突变的比例,来源:药明康德

但如此重要的靶点,却始终难以成药。由于RAS蛋白表面光滑,缺乏传统小分子药物易于结合的“口袋”,针对RAS的药物研发在过去四十年里屡屡碰壁,成为肿瘤学领域一座难以逾越的高峰。直到近几年,安进的Sotorasib( Lumakras)与Mirati的Adagrasib(Krazati)两款KRAS G12C抑制剂相继获批上市,这一领域才迎来实质性突破,彻底改写了RAS靶点“不可成药”的历史。

这两款药物均属于RAS(OFF)抑制剂,能够特异性地靶向KRAS蛋白上由G12C突变产生的半胱氨酸残基,并与处于非活性状态(GDP结合状态,即“OFF”状态)的KRAS G12C蛋白共价结合,但患者易产生耐药性,为后续药物研发留下了突破空间。

尽管如此,二者的突破还是迅速点燃了市场热情,MNC纷纷投入重金加速布局:BMS以48亿美元现金+最高10亿美元里程碑付款收购Mirati;加科思就其泛KRAS抑制剂与阿斯利康达成总额约20亿美元的BD合作;拜耳以13亿美元总额拿下Kumquat Biosciences的一款KRAS G12D抑制剂。

这些交易充分印证,KRAS已成为肿瘤领域最具战略价值的赛道之一。据EvaluatePharma预测,到2030年全球RAS抑制剂市场规模将突破200亿美元,其中KRAS靶点占比超七成,市场潜力巨大。

一众潜力标的中,Revolution无疑是竞争力最强的领跑者。其核心管线Daraxonrasib(RMC-6236)并非针对单一突变,而是一款靶向RAS活性态(GTP结合态)的泛KRAS(ON)分子胶降解剂,可同时靶向G12D、G12V、G13D等多种突变,不仅能覆盖更广泛患者群体,更有望克服传统RAS(OFF)抑制剂的耐药问题。

目前,Daraxonrasib已有四项全球III期临床试验在推进中,覆盖胰腺癌一线、二线及术后辅助治疗等关键场景,且已在胰腺导管腺癌(PDAC)中已展现出颠覆性疗效,成为其核心价值支撑。

在2025年美国临床肿瘤学会胃肠道癌症研讨会(ASCO GI)公布的临床数据显示,二线及以上治疗的转移性PDAC患者中,Daraxonrasib单药治疗携带RAS G12X突变或任何RAS突变患者的疾病控制率(DCR)分别高达92%和95%,客观缓解率(ORR)分别达到35%和29%,且安全性良好,治疗相关不良反应导致停药的比例较低。相较于现有化疗方案3%-17%的ORR,这一疗效堪称跨越式突破。

不仅如此,在一线治疗场景中,Daraxonrasib单药治疗ORR达47%,与标准化疗方案(吉西他滨+白蛋白紫杉醇,GnP)联用时,ORR进一步提升至55%,DCR维持在90%的高位。这意味着该药物不仅有望成为晚期胰腺癌的后线救命药,更可能重塑一线治疗标准。

Revolution的价值远不止Daraxonrasib这一款“明星管线”。不同于行业内多数企业聚焦单一RAS突变亚型的单点突破模式,公司以RAS(ON)抑制技术为核心,构建了覆盖多突变亚型的完整管线矩阵。

图:Revolution在研管线,来源:公司官网

如针对KRAS G12D突变的Zoldonrasib(RMC-9805)在I期临床试验中,对PDAC患者的ORR达30%、DCR达80%,能显著降低KRAS G12D变异等位基因频率;针对G12C突变的Elironrasib已进入临床阶段,针对G12V突变的抑制剂处于临床申报准备阶段,同时还在布局Q61H、G13C等罕见RAS突变亚型的靶向药物,形成了全面的赛道覆盖优势。

平台型企业的价值注定远高于单一管线公司,尤其在RAS这种千亿级潜在市场中,平台化能力意味着持续的创新动能与长期掌控赛道的潜力。Revolution凭借前沿的RAS(ON)技术平台与全维度管线布局,已然具备成为RAS领域领军者的潜质。

对于默沙东而言,收购Revolution不仅是获得一款潜在重磅炸弹级药物,更能直接掌控RAS抑制剂赛道的未来话语权,这也是默沙东此前愿以高溢价收购的核心逻辑,即便双方最终因估值分歧中止谈判,市场对其管线价值的认可仍未减弱。

默沙东不惜溢价洽购Revolution,正是应对自身增长困境的关键谋局。面对“药王”K药专利悬崖的倒计时阴影,默沙东的业绩焦虑与战略紧迫感早已浮出水面。

财报数据显示,2025年上半年默沙东总营收为313.35亿美元,同比下滑2%。作为公司核心支柱的K药,虽仍维持销售额正向增长,但增速已从2024年同期的18%大幅放缓至7%,增长乏力的态势进一步凸显。更严峻的是,K药核心专利将于2028年起陆续到期,届时生物类似药的冲击与市场定价压力将接踵而至,分析师预测,未来五年其销售额或因仿制药竞争缩水180亿美元,营收缺口亟待填补。

在业绩压力倒逼下,默沙东近年来开启密集并购“扫货”模式,通过外部引入快速扩充管线矩阵:2021年以115亿美元收购罕见病药企Acceleron Pharma,2023年斥资108亿美元将免疫领域企业Prometheus Biosciences纳入麾下,2025年先后以100亿美元收购呼吸系统疾病药物开发商Verona Pharma、92亿美元收购抗感染药物企业Cidara Therapeutics,持续通过多元化布局对冲核心产品增长风险。

从分子类型来看,ADC是默沙东近年布局的核心方向,希望打造“ADC+IO”标杆。2022年以来,公司加速ADC赛道布局:先是与科伦博泰达成超百亿美元合作,一举拿下9款ADC药物权益;随后又以220亿美元总价,打包引进第一三共的HER3、B7-H3、CDH6三款ADC管线,快速补齐自身在ADC领域的研发与商业化短板。

然而,ADC赛道虽前景广阔,却早已巨头云集,逐渐进入竞争白热化的“红海”阶段。辉瑞、阿斯利康、吉利德等企业通过巨额并购或深耕研发,已在ADC领域建立起稳固的技术与管线优势。默沙东作为赛道后来者,即便凭借雄厚资本实力快速跟进,要想培育出一款如K药般定义时代、具备绝对统治力的“超级重磅炸弹”,仍面临巨大挑战。

而且其从第一三共引进的 HER3 ADC,因确证性试验未达到主要生存终点,已于 2025 年 5 月 29 日宣布撤回 FDA 上市申请,这一挫折为其ADC争霸之路蒙上了一层阴影。因此,默沙东迫切需要开拓一个更具颠覆性、更具平台延展性的全新增长引擎,夯实自身长远发展根基。

而RAS抑制剂作为“PD-1之后最大的癌症靶点”,其战略地位与当年的PD-1/PD-L1赛道有异曲同工之妙,谁能主导RAS赛道,谁就有望掌握下一代肿瘤靶向治疗的核心话语权,这也是全球药企纷纷加码该领域的核心原因。

由此可见,默沙东想要收购Revolution的核心关键,远不止于获得一款潜在重磅药物,而是希望借助Revolution在RAS赛道建立起的前沿布局,再次建立起如当年K药一般的领先优势。

康方生物AK112在头对头试验中击败K药后,整个生物医药行业仿佛收到了明确信号:双抗将加速接棒PD-1,成为肿瘤免疫治疗的下一代风口。一时间,围绕PD-1的双抗乃至多抗研发热潮席卷行业,各大药企纷纷入局布局,试图复刻或超越这场头对头试验的胜利,仿佛唯有押注双抗,才能在未来的肿瘤治疗市场站稳脚跟。

在这股行业浪潮中,默沙东虽迅速跟进,以数十亿美元引进同类双抗分子,但相较于早早布局的先行者,其在双抗领域的研发进度已明显落后。在外界看来,这家曾凭借K药定义了一个免疫治疗时代的巨头,似乎正错失下一个核心风口,陷入战略被动。

但拉长时间维度审视生物医药的创新史便会发现,行业所谓的“标准答案”从来都是暂时的,真正的颠覆者,往往不是跟风逐浪的追随者,而是敢于开辟新赛道的开创者。

上世纪末,当化疗与靶向治疗仍是肿瘤治疗的绝对主流时,行业共识普遍认为“免疫治疗难以突破肿瘤微环境的屏障”,PD-1单抗的研发前景被普遍看淡。但默沙东顶住质疑,坚持推进K药的临床研发,最终凭借颠覆性疗效改写了全球肿瘤治疗格局,印证了“真理往往掌握在少数人手中”。

如今的PD-1双抗热潮,本质上仍是免疫检查点抑制剂的技术延伸,是在现有治疗框架内的优化升级,而非从底层作用逻辑上的突破性创新。这种迭代式研发虽能在短期内收获行业关注、抢占部分市场份额,却极易陷入同质化竞争的泥沼,最终沦为价格战的牺牲品,很难复刻K药的时代统治力。

这也正是默沙东将目光锁定RAS赛道的核心原因。与双抗的“优化升级”不同,RAS抑制剂从根源上阻断癌细胞生长信号,与K药激活免疫系统攻击肿瘤的作用机制天然互补,二者联用有望实现“1+1>2”的协同增效,为攻克胰腺癌等难治性实体瘤提供全新方案。

尤为关键的是,若Revolution的核心管线Daraxonrasib与K药联用,能有效逆转免疫耐药、将“冷肿瘤”转化为“热肿瘤”,默沙东将不仅收获一款潜在重磅RAS药物,更能为K药搭建强大的疗效增效器,进一步延长其生命周期,对冲专利到期风险。

从默沙东近年密集的收购与BD布局中,不难窥见其对自身资源、时间窗口的清醒认知。凭借K药仍在持续产生的巨额现金流,默沙东的BD布局从不局限于单一热门领域,而是聚焦“存在可解决的未满足临床需求,且与自身战略方向一致”的核心目标,筛选覆盖早期探索至临近商业化的多元化管线资产,实现长期创新与短期突破的平衡。

对默沙东而言,在K药专利悬崖的倒计时下,早已没有退路可言。即便此次天价收购Revolution的谈判因估值分歧中止,但也无法改变默沙东继续“豪赌”的决心。这本质上仍是默沙东以战略上的确定性投入,对抗生物医药行业科学研发与商业转化的双重不确定性。这并非默沙东第一次押注未来,更不会是最后一次。

这场豪赌的成败尚未可知,生物医药研发的高风险性、市场竞争的复杂性,都可能让最终结果偏离预期。但巨头的宿命,本就是在时代风暴中不断寻找新的锚点。每一次坚定押注,都是对行业趋势的精准判断,更是对自身创新信念的坚守。

后K药时代的全球肿瘤治疗格局,RAS赛道是重要参与者,但同样也并不是唯一答案。

【本文系基于公开资料撰写,仅作为信息交流之用,不构成任何投资建议。 】

更多精彩内容,关注钛媒体微信号(ID:taimeiti),或者下载钛媒体App

2026-02-02 19:44:27

文 | 字母AI

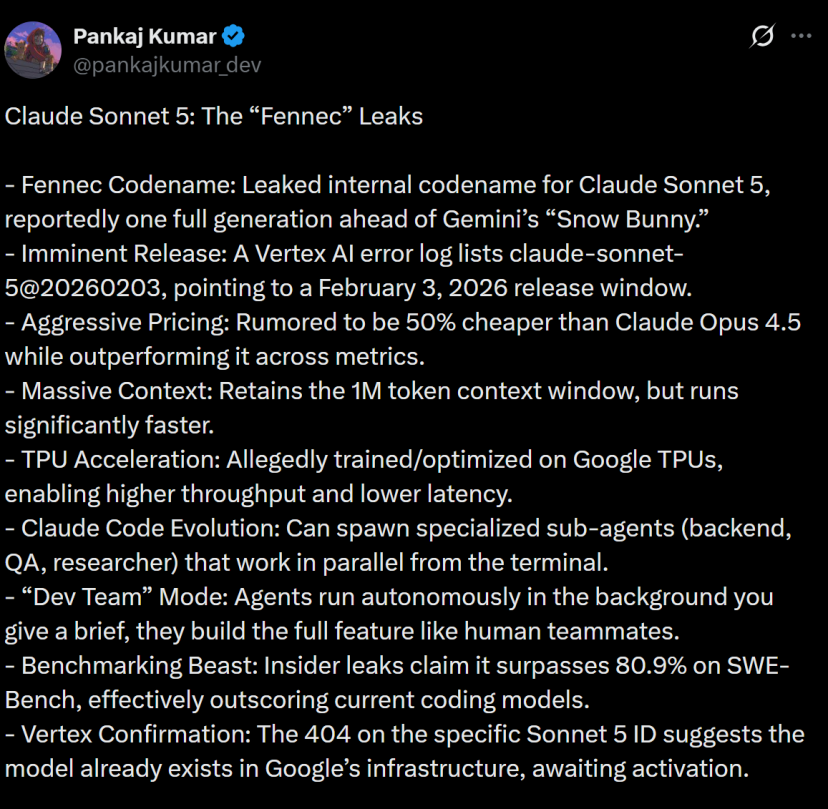

2月2日,X上一位的知名AI博主Pankaj Kumar (@pankajkumar_dev),爆料了Anthropic的下一代旗舰模型Claude Sonnet 5。

这个模型代号为“Fennec”,可能在明天或者后天就要正式发布了。

事情的起因是Google Vertex AI的一条错误日志。

有人在调用API时发现了一个奇怪的模型ID:claude-sonnet-5@20260203。这个模型的日期指向了2026年2月3日。

虽然访问这个ID会返回404错误,但这也足以说明模型已经存在于 Google 的基础设施里,只是还没有激活。

泄露的资料显示,Claude Sonnet 5在性能上要比当前的Claude Opus 4.5更强,但价格却便宜了一半。这是因为Claude Sonnet 5是在Google的TPU上训练和优化的,所以其推理成本大幅降低。

Claude最让人在意的地方就是其编程能力。

内部测试数据显示,Claude Sonnet 5在SWE-Bench上的得分超过了 80.9%。意味着它能独立完成大部分软件工程师日常会遇到的问题。

更有意思的是一个叫“Dev Team”模式的功能。

你给它一个需求简报,它会自动生成多个专门的子代理,分别负责后端开发、质量保证、需求研究等不同角色,然后这些代理在后台并行工作,像一个真实的开发团队那样协作完成整个功能。

这不再是简单的代码生成工具,而是在模拟整个软件开发流程。

Claude Sonnet 5保留了100万tokens的上下文窗口,而且运行速度提升。对于需要处理大量代码库或长文档的用户来说,这个更新是非常必要的。

现在用户可以把整个项目的代码都塞进Claude Sonnet 5里,让它理解全局再做修改。

Claude Sonnet 5发布的时间节点也非常有意思,正好和OpenAI的Codex发布月撞车。

CodeX是一个能够独立完成长达24小时任务的自主软件工程agent。它可以处理多步骤重构、测试驱动迭代和自主调试,甚至在测试阶段发现了React框架中三个此前未知的零日漏洞。

除此以外,OpenAI还在这几天发布了Prism。

这是一个专门为科学研究设计的AI工作空间,把GPT-5.2直接嵌入到LaTeX编辑环境里。研究人员可以在一个界面里完成论文撰写、文献检索、公式编辑和实时协作,不用再在多个工具之间来回切换。

而科学和代码正是Claude的强项,Anthropic选择在此时间点发布模型,无疑是想和OpenAI进行正面较量。

Anthropic在资本市场上的动作也很激进。1月底,公司完成了一轮超过100亿美元的融资,估值达到3500 亿美元。

这轮融资的规模最终可能达到200亿美元,超过了最初计划的100亿。

根据Menlo Ventures在2025年Q4的统计,Anthropic现在占据了企业LLM支出的40%,超过了OpenAI的27%和谷歌的21%。

公司85%的收入来自企业客户,这个结构更健康稳定。

公司CEO达里奥·阿莫迪曾经表示,Anthropic过去三年,收入每年10倍增长。2023年从1亿美元,2024年10亿,2025年会在80到100亿之间。

不仅如此,Anthropic的开发者工具Claude Code在开放半年后,其年化收入就实现了突破10亿美元。

但高速增长的另一面是持续烧钱。Anthropic最近把实现正现金流的时间从2027年推迟到了2028年。

阿莫迪预计2026年会花掉大约120亿美元用于模型训练,另外70亿美元用于运行这些模型。

与此同时,Anthropic把2025年的毛利率预期从50%下调到了40%。

但是相对的,阿莫迪预计Anthropic在2026年的收入会达到180亿美元,2027年达到550亿美元。

如果这个增长能实现,到2028年单位成本会因为规模效应而下降,那时候才有可能实现盈利。

Anthropic的效率比OpenAI要快。后者预计要到2029年或更晚才能盈利。

Anthropic还表示,将自建约100万颗谷歌TPU v7芯片。英伟达最想吃下的客户之一,现已加入谷歌阵营。

同一时间,Anthropic已经聘请了律师事务所Wilson Sonsini为IPO做准备,时间定在了2026年的下半年。

更多精彩内容,关注钛媒体微信号(ID:taimeiti),或者下载钛媒体App